CENTUS oq qog'ozi

Kirish

Zamonaviy dunyoda ko'plab raqamli valyutalar yaratilgan va ular kvazi-pul sifatida foydalanilmoqda. Kriptovalyutalar ko'pincha davlat tomonidan tartibga solish darajasida chiqarilgan pul bilan bir xil funktsiyalarga ega va tovar birjasida vositachi vosita sifatida ishlaydi.

Davlat tomonidan chiqarilgan pullar (fiat) singari, raqamli valyutalar ham jamiyat rivojlanishining cheksiz jarayoni bilan bir qatorda to'laqonli uzluksiz rivojlanish bosqichidan o'tadi:

– Fast response to scientific and technological progress. All engineering and technological achievements are implemented in the money production process.

– Increase in the speed of money circulation, and, as a result, the speed of payments. In turn, this trend is limited in the growth of the payment acceleration price (the growth of commission for conducting and other costs) and its security (ambition to minimize the risk of losing money during the payment).

– Increased availability of payment tools and controllability of the funds transfer process. Enterprises and buyers strive to use the most affordable and simple payment tools.

Biroq, hisob-kitob tizimida raqamli valyutalardan foydalanish, kriptovalyutani saqlash va kundalik hayotda foydalanishning barcha aniq afzalliklari bilan ular biznesda ham, iste'molchi darajasida ham ommaviy arizani olmagan. Bizning fikrimizcha, bu quyidagi muammolar bilan bog'liq:

No. 1: Kriptovalyutani tushunish qiyin

2-masala: Beqarorlik va o'zgaruvchanlik

3-muammo: Huquqiy va texnik jihatdan tartibga solishning yo'qligi

4-muammo: Raqamli valyutani haqiqiy dunyoga chiqarishning hech qanday usuli yo'q

Private issuers who issue their digital currencies for various purposes carry out informing and training of users on the cryptocurrency market, helping them to understand its nature and ways of using it. The infrastructure required for effective operation is developing at the right pace to solve the problem of cryptocurrency output to the real world. However, in order to make a typical purchase or exchange operation and get the result in the form of real goods or cash, the user needs to use the services of several companies, each of them requires additional time to conduct the transaction and high costs in the form of commissions. At the intersection of two – cryptocurrency economy and classical economy, the problem of developing a single solution has become more urgent than ever.

Bitkoin (BTC) va boshqa kriptovalyutalarning narxlari o'zgaruvchanligi keng tarqalgan qabul qilish uchun eng katta to'siqlardan biridir. Qog'oz valyutalardan (fiat) farqli o'laroq, zamonaviy raqamli valyutalarda barqaror xarid qobiliyatini saqlab qolish uchun pul-kredit siyosatini amalga oshiradigan Markaziy bank mavjud emas, ya'ni talabning o'zgarishi narxlarning katta o'zgarishiga olib kelishi mumkin. Agar foydalanuvchilar o'z hisoblarining xarid qobiliyati barqaror bo'lib qolishiga ishonch hosil qila olmasalar, ular hech qachon barqaror qiymatga ega bo'lgan muqobil aktivlar o'rniga kriptovalyutani ayirboshlash vositasi sifatida ishlatmaydi. Ko'pgina tadqiqotlar tranzaksiya o'tkazuvchanligi va aqlli shartnomalar kabi texnik mavzularga qaratilgan bo'lishiga qaramay, ular bilan taqqoslaganda, narx barqarorligini oshirishga deyarli e'tibor berilmaydi va biz bu muammoni ommaviy qabul qilish uchun ancha jiddiy to'siq deb hisoblaymiz. ayirboshlash vositasi sifatida kriptovalyuta.

CENTUS barqaror qiymatni saqlab qolish, shuningdek, o'z egalari uchun muntazam asosiy daromad (senyoraj) olish uchun mo'ljallangan va u Internetga ulangan har bir kishi uchun mavjud bo'lgan ayirboshlash vositasidir.

CENTUS raqamli valyuta bo'lib, token ishonchliligi to'liq markazlashtirilmagan holda AQSh dollariga bog'langan holda ta'minlanadi. CENTUS protokoli CENTUS kursining AQSh dollariga nisbatan o'zgarishiga javoban CENTUS tokenlarining chiqarilishini algoritmik tarzda sozlaydi. Bu butun dunyo bo'ylab Markaziy banklar siyosatiga o'xshash pul-kredit siyosatini amalga oshirish imkonini beradi, faqat u to'g'ridan-to'g'ri inson aralashuvisiz protokollar asosida markazlashtirilmagan algoritmdan foydalanadi.

CENTUS kredit va ish haqi xizmati yoki boshqa yirik moliyaviy shartnomalar uchun foydalanishda valyuta o'zgaruvchanligi muammosining mumkin bo'lgan yechimiga aylanishi mumkin.

Bundan tashqari, CENTUS va boshqa barqaror tangalar o'rtasidagi eng muhim farq shundaki, uning egalari har hafta (seshanba va juma kunlari) to'g'ridan-to'g'ri ishtirokchilar hamyoniga to'lanadigan muntazam asosiy daromadni (senyoraj) oladilar.

CENTUS taklifni algoritmik ravishda sozlash orqali narxlarni barqaror saqlash uchun ishlab chiqilgan.

CENTUS missiyasi boylik yaratish va uni oddiy odamlar - Centus Seigniorage tarmog'i a'zolari o'rtasida qayta taqsimlashdir.

Stabil Cent (CENTUS) - Stellar blokcheynidagi algoritmik barqaror raqamli valyuta. Muomaladagi Barqaror Centlar soni bozordagi talabga qarab belgilangan algoritmga muvofiq ortadi yoki kamayadi.

100 CENTUS ≈ 1 AQSh dollari

Ishtirokchilarga CENTUSni sotib olish va sotish imkonini berish orqali aqlli shartnoma marketmeyker bo'lib xizmat qiladi. CENTUSni sotib olish uchun ishtirokchilar pul mablag'larini o'zgaruvchan zaxira sifatida saqlanadigan aqlli shartnoma manziliga o'tkazishlari kerak. CENTUS zaxirasining asosiy maqsadi ishtirokchilarga istalgan vaqtda o'zlarining CENTUS tokenlarini sotish imkoniyatini berishdir; shartnoma zaxiradagi mablag'lardan foydalangan holda CENTUSni sotib oladi.

Haftada ikki marta "aqlli shartnoma" yangi CENTUSni chiqaradi va bozor talabini inobatga olgan holda ularni mavjud CENTUS egalari o'rtasida mutanosib ravishda taqsimlaydi.

Natijada, CENTUS egalari "Seigniorage" deb nomlangan daromad olishadi.

Seigniorage is the state’s revenue from issuing money. Central banks can influence the level of seigniorage that governments receive by regulating the growth rate of the monetary system.

Biz CENTUSni mavjud CENTUS egalari orasida taqsimlash tizim barqarorligining asosiy asosi ekanligiga ishonamiz. Bundan tashqari, biz ushbu spekulyativ komponent CENTUS barqarorligini ta'minlashiga aminmiz.

Senyoraj CENTUS egalari o'rtasida taqsimlanganda, tanga ikki qiymat manbasiga ega: CENTUS barqaror sentining o'zi va odamlar haftasiga ikki marta oladigan senyoraj. CENTUS Stabil Cent 1 US CENT (¢) ga bog'langan. CENTUS egalari muntazam ravishda senyoraj olishlari sababli, CENTUS narxi 1¢ + senyorajga teng.

Agar bozor ishtirokchilari yaqin kelajakda CENTUS egalariga yangi to'lovlarni kutishsa, ular spekulyativ sabablarga ko'ra CENTUSni sotib olishlariga ishonamiz. CENTUS algoritmi ushbu ortib borayotgan talabga tangalar narxini 1 AQSH sentiga qaytarish uchun yangi CENTUS yaratish orqali javob beradi.

Garchi bu chayqovchilarni ushbu yangi tangalardan foyda olish uchun ko'proq CENTUS sotib olishga undashi va uzoq vaqt davomida sun'iy o'sish va narxni 1 tsentdan yuqori ushlab turishiga olib kelishi mumkin bo'lsa-da, CENTUSda narxlarni ko'tarish paytida senyorajni pasaytirish algoritmi barqarorlashuvga foydali ta'sir ko'rsatadi. kursi taxminan 1 sent darajasida.

Mavjud CENTUS egalariga yangi tangalarni tarqatish faqat CENTUS qiymatini oshiradi, deb o'ylash tabiiydir, chunki u odamlarni CENTUSni qabul qilganliklari uchun mukofotlaydigan jozibali spekulyativ komponentni yaratadi.

Biz ishonamizki, ushbu spekulyativ komponentni qo'shish doimiy talabni rag'batlantiradi va o'zgaruvchan foiz senyoraji CENTUSning barqaror qiymatini buzmasdan faqat foyda keltiradi.

Bizning prognozlarimizga ko'ra, bu bozor ishtirokchilari uchun CENTUSning real va uzoq muddatli qiymatini sezilarli darajada oshiradi.

CENTUS kelajakda "chop etilmaydi" - har bir birlik foydalanuvchi uni sotib olganida yaratiladi va teskari almashinuvda - yo'q qilinadi. Shunday qilib, zaxiraga o'tkazilgan aktivlar CENTUS aktsiyalarini himoya qiladi.

CENTUS token is, first of all, not a token for speculation by exchange traders, but mainly a means of accumulation and income generation by simple people – its owners, as well as a means of settlements between them.

Biz uchinchi tomon investorlaridan tashqi moliyalashtirishni izlamaymiz, chunki kelajakda ular erta investitsiyalar evaziga yuqori daromad talab qilishlari sababli, biz ushbu yuqori daromad CENTUSni birinchi vositachilarsiz sotib olgan odamlarga bevosita yuborilishi mumkinligiga chin dildan ishonamiz. .

CENTUS protokoli bilan solishtirsangiz, tushunish osonroq bo'ladi Federal zaxira (FED). FED singari, CENTUS aqlli shartnomasi ham ochiq bozorda operatsiyalarni amalga oshirish orqali narx darajasini nazorat qiladi va pul taklifini moslashtiradi, bu bizning holatlarimizda CENTUS tokenlari yoki BILLEX tokenlarini yaratishdan iborat (bu haqda quyida batafsil aytib beramiz). FEDda bo'lgani kabi, bu operatsiyalar pul miqdori nazariyasi bilan uzoq muddatli narx darajasini istalgan qoziqda ishlab chiqarish uchun bashorat qilinadi.

CENTUS likvidligi

The CENTUS currency includes a liquidity mechanism designed to mitigate the impact of market forces when they cause volatility in the value of CENTUS. The CENTUS smart contract offers a permanent sale of new CENTUS tokens at a price close to 0.01 US dollars. And vice versa, the contract offers to buy back and destroy CENTUS tokens at a price close to 0.01 dollars. A smart contract allows a spread within which speculative participants can earn profits by maintaining the coin’s peg.

Shunday qilib, CENTUS tokenlarining taklifi talab bilan belgilanadi: tokenlar bozorga qarab chiqariladi yoki muomaladan chiqariladi. Bundan tashqari, CENTUS qiymati sotib olish narxi va taklif narxi o'rtasida. CENTUS aqlli shartnomasida belgilangan diapazonda tranzaktsiyalar ikkilamchi bozorlarda aqlli shartnomani jalb qilmasdan amalga oshirilishi mumkin.

Yangi CENTUS tokenlarini chiqarishdan olingan daromadlar to‘liq zaxiraga olingan. Zaxira faqat CENTUS tokenlarini sotish orqali yaratiladi va uning yagona maqsadi CENTUS aqlli shartnomasiga kerak bo'lganda tokenlarni qaytarib olish imkoniyatini berishdir. Zaxirani saqlash xarajatlari zahiraning o'zi tomonidan qoplanadi.

About Tokens

These are the main tokens of the system. They are pegged to the US dollar and intended to be used as means of exchange and revenue generation through the distribution of seigniorage among token owners. Their offer increases and decreases in order to maintain a price peg to 0.01 US dollars.

The CENTUS design and development process requires funding. We believe that this process should reflect the values and principles that we want to promote. Since our project declares integrity and low volatility, we did not want to start the development of CENTUS with public speculation through ICO. Accordingly, we decided to use only the founders’ own funds as the first participants of the CENTUS project.

Biz Debit Coin (DBC) deb nomlangan maxsus tokendan dastlabki taʼsischilarga va boshqa manfaatdor tomonlarga kompensatsiya berish uchun foydalanamiz. DBC - bu vaucher tokeni bo'lib, uni o'z xohishiga ko'ra CENTUSga aylantirish mumkin. Konvertatsiya paytida olingan CENTUS miqdori oldindan modellashtirilgan va CENTUS iqtisodiyoti hajmiga bog'liq: miqdor noldan boshlanadi va faqat CENTUS iqtisodiyoti haqiqiy muvaffaqiyatga erishgan taqdirdagina ortadi. Bu DBC egalarining manfaatlari CENTUS egalarining manfaatlariga zid kelmasligini ta'minlaydi.

DBC tokenlari soni 100 millionga teng. Ushbu tokenlarning egalari taklif oshirilganda to'lanadigan senyoraj foiz stavkasi bo'yicha ovoz berish huquqiga ega.

DBC CENTUS iqtisodiyotiga ta'sir qilish bo'yicha o'rnatilgan cheklovga ega. DBC-ni CENTUS-ga o'tkazish tezligi 1:500 bilan cheklangan, shuning uchun DBC egalarining umumiy ta'siri cheklangan. Har qanday jismoniy shaxsning ta'sirini kamaytirish uchun aktsiyalarning hajmi ham bitta mulkdor uchun maksimal 30 foiz bilan cheklangan.

DBC owners will only be able to receive a seigniorage on this asset in case the capitalization of CENTUS gets at least 10 million. After that, as the system grows and the number of CENTUS in circulation increases, the amount of seigniorage for DBC owners will gradually increase from 10% to 50% of the total amount of accrued seigniorage.

Shunday qilib, DBC egalari eng yuqori xavfni o'z zimmalariga oladilar. Buni kompaniyaning oddiy aktsiyalariga egalik qilish bilan solishtirish mumkin, CENTUS esa ko'proq imtiyozli aktsiyaga o'xshaydi, "kafolatlangan" senyorajga ega, ammo ovoz berish huquqi va super-dividendlarsiz.

DBC har doim joriy kurs bo'yicha CENTUS ga almashtirilishi mumkin. DBC tezligi qanchalik yuqori bo'lsa, shuncha ko'p CENTUS olishingiz mumkin (maksimal chegara 500 CENTUS). DBC faqat bir marta almashtirilishi mumkin va ular aylanmadan chiqariladi va almashish vaqtida yondiriladi.

Blokcheyndagi chegirmali veksellar. Ushbu tokenlar CENTUS taklifini kamaytirish kerak bo'lganda blokcheyn auktsioni orqali sotiladi. BILLEX hech narsa bilan bog'lanmagan va har bir veksel egasi kelajakda ma'lum bir nuqtada ma'lum shartlar ostida aynan bitta CENTUS olishini va'da qiladi. Yangi yaratilgan BILLEX ochiq kim oshdi savdosida bir CENTUSdan kamroq narxga sotilganligi sababli, siz raqobatbardosh bonus yoki “yield” for buying bills when they are redeemed at par.

BILLEX sotib olinadigan shartlar:

- Aqlli shartnoma CENTUSni yaratadi va tarqatadi, ya'ni u CENTUS ta'minotini ko'paytirish zarurligini belgilaydi.

- BILLEX muddati tugamagan, ya'ni. u 1 yildan kamroq vaqt oldin yaratilgan.

- Oldingi barcha BILLEX tokenlari ushbu BILLEX tokenlari sotilishi yoki muddati tugashidan oldin yaratilgan.

Barqarorlikni ta'minlash uchun tokenlarning o'zaro bog'lanishi

CENTUS butun dunyo bo'ylab Markaziy banklar tayanadigan bir xil iqtisodiy tamoyillardan foydalangan holda narxlar barqarorligini ta'minlaydi. Ulardan eng muhimi pul miqdori nazariyasi. Ushbu bo'limda biz quyidagi mavzularni ko'rib chiqamiz:

- Pulning miqdor nazariyasi uzoq muddatli narx darajasini pulga talab va taklif bilan qanday bog'laydi?

- CENTUS protokoli CENTUS va uning bog'langan aktivlari o'rtasidagi almashuv kursini kuzatish orqali talabning o'zgarishini qanday baholaydi?

- CENTUS protokoli valyuta kursi asosida CENTUS tokenlarining chiqarilishini qanday oshiradi va kamaytiradi?

- CENTUS ta'minotini ko'paytirish va kamaytirish uchun bozorlarni yaratish.

History shows that in times of rising and falling markets, people often make economically significant decisions under the influence of panic and without regard for common sense. During an economic boom, people have more money, so they want to buy more goods, which leads to higher prices for goods, which encourages demand for higher wages, which means that people have even more money. This phenomenon is known as the inflationary spiral, and this is what happened in Germany in the 20s, Brazil in the 80s and Argentina in the 90s. Similarly, in an economic downturn, people are afraid to buy goods, resulting in lower prices for goods, which causes people to postpone purchases until prices fall further, and so on. This phenomenon is known as the deflationary spiral – and it almost happened during the global recession of 2008. In such situations, a responsible Central Bank can step in to cut off these destructive feedback loops. So how exactly are Central banks coping with this task?

Imagine that prices in the state economy are at some level, for example, the average cost of a predetermined “basket of goods” is $100. The quantity theory of money states that if you double the amount of money that everyone had in their bank accounts, the same basket of goods will end up being worth $200. Why is that? Although the nominal amount of money has doubled for everyone, the true value of goods has remained the same. This means that people must be willing to part with twice as much nominal money to get the same amount of value. The same principle applies in the opposite direction: if we take half of people’s savings out of the economy, the same basket of goods will end up costing just $50.

Ushbu kontseptsiyani kengaytirib, biz markaziy bank inflyatsiyani yumshatishga harakat qilgan vaziyatni ko'rib chiqamiz. Doimiy ravishda o'sib borayotgan yuqori narxlar odamlarning pul sarflashga juda tayyorligini anglatadi. Biz qila oladigan narsa odamlarning narxlarni tiklash uchun pul miqdorini cheklashdir. (Buni qanday qilish mumkinligi haqida hozircha to'xtalib o'tirmaymiz) Xuddi shunday, aksincha, deflyatsiyaga ham tegishli bo'lib, bu odamlarni pul sarflashni istamaydi. Narxlarni tiklash uchun biz odamlarga ko'proq pul berishimiz mumkin. Bu oddiy, ammo muhim g'oya, aynan markaziy banklar narxlarni barqarorlashtirish uchun nima qiladi. Markaziy banklar tomonidan pul-kredit siyosatini amalga oshirish uchun foydalaniladigan vositalar murakkab va tushunish qiyin bo'lishi mumkinligidan tashqari, masalan, ochiq bozor operatsiyalari va zaxira talablariMarkaziy bank ikkita vazifani bajaradi:

- Pul massasini ko'paytirish. Agar markaziy bank narxlar pasayib borayotganini aniqlasa, narxlarni avvalgi darajaga qaytarish uchun pul taklifini oshirishi mumkin.

- Pul taklifini kamaytirish. Agar markaziy bank narxlar oshishini aniqlasa, u narxlarni avvalgi darajasiga qaytarish uchun pul taklifini kamaytirishi mumkin.

Pul massasining ko'payishi va kamayishi o'z samarasini beradi, chunki pulning miqdor nazariyasi iqtisodiyotdagi uzoq muddatli narxlar muomaladagi pulning umumiy taklifiga mutanosib ekanligini ta'kidlaydi. Quyida CENTUS kabi valyutada barqaror narx darajasini saqlab qolish uchun foydalaniladigan nazariyaga misol keltirilgan:

Aytaylik, siz CENTUS kabi valyutani dollarga bog'lamoqchisiz, shunda bitta token har doim 0,01 AQSh dollariga sotiladi. Joriy ayirboshlash kursi istalgan qoziqdan qanchalik uzoqligiga qarab, token ta'minotini oshirish yoki kamaytirish orqali buni amalga oshirishingiz mumkinligini ko'rsatamiz.

Birinchidan, biz yalpi talab tushunchasini kiritamiz. Konseptual tarzda, yalpi talab qancha odam birgalikda tanga olishni xohlashini tavsiflaydi:

talab = (tanga narxi) * (muomaladagi tangalar soni)

Bu tanganing bozor kapitallashuvi sifatida ham tanilgan, chunki bozor kapitallashuvi teng ravishda qancha odam tangani birgalikda qabul qilganligini tavsiflaydi.

X muomaladagi tangalar sonini, ya'ni tangalar ta'minotini ifodalasin. Faraz qilaylik, so'nggi bir necha oy ichida talab oshdi, shuning uchun tangalar hozirda 1,10 dollarga sotilmoqda:

talab = $1,10 * X

1 dollarlik qoziqni tiklash uchun tangalar taklifi qanday sozlanishi mumkinligini aniqlash uchun talab doimiy bo‘lib qoladi deb faraz qilaylik va Y muomaladagi tangalarning kerakli sonini ko‘rsatsin:

oldin talab = $1,10 * X

keyin talab = $1.00 * Y

oldin talab = keyin talab

Y uchun yechim bitta CENTUSni 0,01 AQSh dollariga sotish uchun tanga taklifini 1,1 baravar oshirish kerakligini anglatadi:

Y = X * 1.1

Taxminiy hisob-kitob sifatida, pulning miqdoriy nazariyasi shuni ko'rsatadiki, agar CENTUS juda yuqori yoki juda past bo'lgan P narxida savdo qilsa, protokol mavjud taklifni P ga ko'paytirish orqali uzoq muddatli narxlarni 1 dollargacha tiklashi mumkin. Ba'zi texnik tafsilotlar mavjud. , keyinroq biz protokol qanchalik tez reaksiyaga kirishishi, narxlar qanchalik tez reaksiyaga kirishishi va hokazolar haqida gaplashamiz, lekin asosiy g'oya shundan iboratki, uzoq muddatda qoziqni saqlab qolish uchun biz faqat CENTUS narxini o'lchashimiz va tokenni sozlashimiz kerak. mos ravishda yetkazib berish.

We have found out that CENTUS will maintain its peg in the long term if the token supply is adjusted when the token price has changed. How does the CENTUS pro- tocol measure the price of a token? How does this regulate the offer?

Bu erda biz CENTUS protokolining to'liq spetsifikatsiyasini taqdim etish orqali ushbu muammolarni hal qilamiz. Yaxshiroq tushunish uchun protokolda bitkoin (BTC) kabi an'anaviy kriptovalyutaning barcha texnik xususiyatlari va quyidagi qo'shimcha funktsiyalar mavjud deb taxmin qilishimiz mumkin:

• The protocol defines the target asset for stabilization. This is a US cent for CENTUS. Then the protocol determines the CENTUS target rate to the target asset – 0.01 US Dollar for one CENTUS.

• The smart contract monitors exchange rates to measure the price. The smart contract receives the CENTUS-USD exchange rate source via the Oracle system. This can be done in a decentralized way, as we will describe later.

• The smart contract increases or reduces the supply of CENTUS tokens in re- sponse to deviations of an exchange rate from the peg.

• Smart contract distributes seigniorage to all existing CENTUS owners dur- ing periods of increased supply.

” If CENTUS trades for more than $ 0.01, the smart contract creates and dis- tributes new CENTUS via seigniorage. These CENTUS are determined by the pro- tocol set priority for owners of BILLEX tokens and DBC tokens.

” If CENTUS trades for less than $ 0.01, the smart contract creates and sells BILLEX tokens at an open auction to withdraw the coins from circulation. BILLEX tokens are worth less than one CENTUS, and they can be redeemed for exactly one CENTUS when the Stable Cents are created to increase the offer. This encourages CENTUS owners to participate in the sale of BILLEX and thereby re- duce the CENTUS supply in exchange for the potential payment of BILLEX to- kens in the future.

First, we will explain how the CENTUS protocol gets the CENTUS-USD ex- change rate. Since this information is external to the smart contract, the CENTUS protocol must implement so-called Oracle system, that is, a system that uploads external information to the blockchain. This can be implemented in several ways:

Secure channel. The simplest approach involves using a single channel that loads the real exchange rate into the blockchain, say from Coinbase, Krak- en, or another major exchange. It is obvious that this is the point of central- ization, but it is the simplest and most convenient option.

Delegated decentralized channel. The semi-decentralized approach is to select a small group of channel loaders by CENTUS owners voting. Using this set of channel loaders, the system can select the average exchange rate from them at fixed intervals. If it is discovered that an unscrupulous player is constantly trying to discredit the channel, he will be excluded from the system by coin owners who have an incentive to preserve the long-term value of the system. This reflects most of the advantages of decentraliza- tion. A similar scheme called Delegated proof of stake (DPoS) is even used in other protocols to generate entire blocks.

Decentralized scheme of Shelling points. A fully decentralized approach is to use the Shelling points scheme to determine the exchange rate. The scheme of Shelling points works like this:

- Anyone on the network can vote for what, as he/she think, was the average ex- change rate for the last 5 minutes.

- Ovozlar har 5 daqiqada jamlanadi va har bir saylovchida bo'lgan tangalar soniga qarab o'lchanadi. Boshqacha qilib aytganda, qancha tangalar bo'lsa, sizning ovozingiz shunchalik ko'p og'irlik qiladi.

- The weighted median value is taken as the true exchange rate. In addition, weighted 25th and 75th percentiles of price estimates are calculated.” People who guess from 25 to 75 percentiles are rewarded with a set number of newly created CENTUS. This award encourages people to vote, and even more so – to vote with consensus.

- At the request of the community, people who fall outside the 25th or 75th per- centile can be fined by reducing their number of votes.

Due to the fact that the calculation is based on the median, taking into account the number of coins in the voting pool, and a consensus-based reward mechanism is used, the scheme in a substantial way protects itself from unscrupulous participants if none of them owns more than 50% of the voting base of coins. Rules for rewards and punishments need to be developed to encourage enough people to vote. If these incentives are designed correctly, the result provides the same level of securi- ty as Bitcoin (which is also vulnerable if a single miner requires more than 50% CPU mining), Ethereum (if it implements proof of participation), and so on.

Xavfsiz kanal va vakolatli markazlashtirilmagan kanal yondashuvlari protokolni xavfsiz yuklashning oddiy usullari bo'lib, ular to'liq markazsizlashtirish va foydalanish qulayligi o'rtasidagi murosani anglatadi. Schelling ball sxemasi yangiroq, ammo biz to'g'ri rag'batlantirishni ishlab chiqish orqali uni ishonchli qilishimiz mumkinligiga ishonamiz. Qanday bo'lmasin, ushbu ilovalarning barchasi CENTUS USD narxlarini CENTUS protokoliga yuklash uchun to'g'ri alternativalardir.

Hozirda CENTUS Coinbase, Kraken va Binance birjalari yordamida real valyuta kurslarini blokcheynga yuklaydi. Kelajakda tarmoqni kengaytirishda Shelling nuqtalarining markazlashtirilmagan sxemasini ko'rib chiqish mumkin bo'ladi.

Ta'minotni ko'paytirish quyida tasvirlanganidek ishlaydi.

Ta'minotni ko'paytirishning asosiy varianti CENTUS-ni uzluksiz sotish va haftasiga 2 marta seshanba va juma kunlari token egalariga senyorajni hisoblash orqali amalga oshiriladi. Foiz stavkasi DBC egalarining ovoz berish natijalariga ko'ra belgilanadi.

Keling, BILLEX orqali ta'minotni oshirish variantini ko'rib chiqaylik.

Birinchidan, aqlli shartnoma barcha ajoyib BILLEX tokenlarini hisoblab chiqadi va ularni eng qadimgilaridan boshlab yaratilish vaqti bo'yicha buyurtma qiladi. Obligatsiyalarning bu tartiblangan ketma-ketligi BILLEX navbati deb ataladi.

Then the smart contract counts all issued CENTUS tokens, creates N new CEN- TUS tokens and distributes them as follows:

- BILLEX owners are paid first in order of priority (FIFO-first in, first out). If there are unpaid BILLEX tokens, the smart contract starts converting BILLEX to CENTUS tokens, one to one, according to their place in the BILLEX Queue. For example, if we need to create 100 CENTUS, we convert the 100 oldest out- standing BILLEX into 100 new CENTUS tokens. The FIFO queue encourages people to buy BILLEX sooner rather than later, since BILLEX purchased earlier is paid out before BILLEX purchased later.

Barcha BILLEXni to'lagandan so'ng, tizim avtomatik ravishda barcha CENTUS egalariga senyorajni qayta taqsimlashni boshlaydi.- Seigniorage are accrued to DBC owners after BILLEX repayment and after distributing payments to all CENTUS owners. In this case, the system dis- tributes seigniorage (the remaining new coins) proportionally to the DBC owners. For example, if we need to create 1 million CENTUS and there are 0 issued (out- standing) BILLEX and 1 million DBC in circulation, then DBC owners will re- ceive between 10% and 50% of coins depending on CENTUS capitalization. The remaining coins are distributed among CENTUS owners.

To prevent situations in which new BILLEX at the end of the BILLEX Queue will not have value for speculators due to excessive queue length, we have provided a limit on the validity of the BILLEX. The more the BILLEX Queue grows, the longer it will take to pay for new BILLEX at the end of the queue. This leads to a lower price for the new BILLEX, as speculators begin to demand higher returns for the extra time and risk they take. But if the price of new BILLEX drops to zero, the system can no longer reduce the offer – zero price means that no one wants to ex- change their CENTUS tokens for BILLEX tokens. To prevent this from happening, we forcibly terminate all BILLEX that have been in the BILLEX queue for more than 1 year, even if they have not yet been redeemed. We chose the validity period of BILLEX 1 year after the simulation showed that this has led to the creation of a reliable system with high prices for BILLEX even in conditions of very large price fluctuations. However, we reserve the details for further discussion of expiration dates up to 5 years in individual cases.

The mechanism for increasing the supply will be easier to understand in the fol- lowing example:

Aytaylik, BILLEX navbatida 500 ta BILLEX veksel mavjud bo'lib, ulardan 200 tasi 1 yildan ko'proq vaqt oldin yaratilgan.

Keling, tizimga 1000 ta yangi CENTUS tangalarini yaratish kerakligini taklif qilaylik.

The system removes the 200 oldest BILLEX from circulation, leaving 300 BILLEX in the queue. If the system needed to create less than 300 coins, it would only buy back the oldest BILLEX. However, the system must create 1000 coins, so it buys back all 300 BILLEX.

The system needs to create another 700 CENTUS coins. The system distributes these 700 coins evenly to existing owners of 1000 CENTUS and 1000 DBC. Each CENTUS and DBC gets 700/1000 = 0.7 / 2=3.5 coins. For example, if you have 100 CENTUS or 100 DBC, you will get 35 coins in the process of increasing the offer and then sell them for USD. (Subject to CENTUS capitalization at $10 mil- lion)

Ta'minotni qisqartirish works as follows. To destroy CENTUS, we must have an effec- tive mechanism that will encourage CENTUS owners not to use their CENTUS in exchange for future payments. We do this by creating a smart contract for BILLEX tokens and then selling them to CENTUS owners. As discussed earlier, BILLEX tokens are sold at an open auction at prices usually less than 1 CENTUS. In return, they promise a future payment of one CENTUS during periods of in- creased supply if the old BILLEX is not in circulation, if the BILLEX has not ex- pired and the BILLEX has not been redeemed within 1 year.

First, we will discuss the open bidding system. To sell BILLEX, the smart contract launches a continuous auction where bidders specify the bid and number of new BILLEX tokens. In other words, auction participants indicate how much they want to pay for each BILLEX and how many BILLEX tokens they want to buy at that price. For example, you can specify that they would like to buy 100 BILLEX at 0.9 CENTUS for one BILLEX. When the system decides to reduce the coin sup- ply, it selects orders with the highest bids and converts the owners’ coins to BILLEX until enough CENTUS are destroyed. As an example:

Keling, tizim 100 BILLEX sotmoqchi ekanligini taklif qilaylik.

Takliflar to'plamida uchta xarid buyurtmasi bor deb faraz qilaylik: har biri 0,8 CENTUS bo'lgan 80 BILLEX uchun bitta taklif, har biri 0,6 CENTUS bo'lgan 80 BILLEX uchun bitta taklif va har biri 0,4 CENTUS bo'lgan 80 BILLEX uchun bitta taklif.

The system calculates the clearing (settlement) price, which is the single price at which all offered BILLEX would be purchased. In this case, the clearing price will be 0.6 CENTUS.

The system executes winning bids at the clearing price: the first user will receive 80 BILLEX in exchange for 80 * 0.6 = 48 CENTUS, and the second user will re- ceive 20 BILLEX in exchange for 20 * 0.6 = 12 CENTUS.

Protokol hozirgi vaqtda tangalar chiqarish bo'yicha shartnomalar tuzish uchun kelajakni juda ko'p qurbon qilmasligini ta'minlash uchun BILLEX token narxiga sun'iy chek qo'yadi. Biz hozirda bu darajani har bir BILLEX uchun 0,10 CENTUS qilib belgilaymiz. Biz BILLEX narxlarini modellashtirdik, hatto CENTUS uchun talab modellarining juda keng doirasi bo'lsa ham, bu darajaga deyarli erishib bo'lmaydi.

IMPORTANT: CENTUS issued on the Stellar blockchain are debited automati- cally from the addresses (accounts) of token holders using the Stellar Clawback function in case the rate deviates from the peg by more than 20%, followed by the accrual of BILLEX tokens in equal amounts.

Since the cost of producing paper money is low, the nominal value of a currency can be much higher than the cost of producing it. For example, it costs from 7 to 20 cents to print a US Federal reserve note depending on its face value. Conse- quently, the paper money printer makes a profit by creating more money. The value of money in comparison with its cost price is called seigniorage.

Seigniorage elektron pul uchun eng yaxshi vositadir.

Senyorajlarning eng ko'p soni elektron pul yaratish bilan bog'liq, chunki elektronika yordamida deyarli har qanday pulni deyarli bepul yaratish mumkin.

Similarly, CENTUS owners are entitled to receive an unconditional basic income from the seigniorage, which is a remuneration distributed among CENTUS own- ers.

We described earlier that the seigniorage is distributed twice a week – on Tuesdays and Fridays. The interest rate is determined by voting among participants – owners of CENTUS and DBC tokens.

According to the results of voting among participants on October 04, 2019, a deci- sion was made and recorded in the Telegram channel (https://t.me/coinger_im) to calculate votes based on two parameters:

- Senyoraj foiz stavkalarining medianlari

- DBC ovozlarining ko'pchiligi

Qiymatlar ikki ko'rsatkichning o'rtacha qiymati asosida hisoblanadi.

At the same time, a mandatory condition for DBC token owners voting is the pres- ence of 100 DBC tokens or more on their wallet. This parameter can be changed up or down by DBC token owners’ decision.

More detailed calculation of the seigniorage percent rate Median value can be found in the description of the voting procedure: CENTUS Blog

09.09.2019-yilda DBC egalari oʻrtasida oʻtkazilgan senyoraj stavkasi boʻyicha ovoz berish monitoringi va oʻtkazilgan tahlillar natijasida senyoraj stavkasini hisoblashning amaldagi algoritmiga quyidagilarni qoʻshishga qaror qilindi:

- 1 COIN = 1 OVOZni hisobga olgan holda DBC aktiviga egalik mezonini hisob-kitobga kiriting. Boshqacha qilib aytganda, sizda qancha tangalar bo'lsa, ovozingiz shunchalik ko'p og'irlik qiladi.

- Ovozlar sanab bo'lingandan so'ng, ikkita ovoz beruvchi aktivdan faqat bittasi bilan ovoz bergan ishtirokchilarga minimal miqdorda BONUS bering. Keyinchalik, shaffof mukofot algoritmi ishlab chiqilishi kerak, ehtimol tangalar soniga qarab yoki o'rtacha prognozga asoslanadi.

- Calculate the final seigniorage rate based on the rates that fall in the range be- tween the weighted 25th and 75th percentiles, based on the voting results.

- To reward people whose desired rates have fallen in the range from 25 to 75 per- centiles with a given amount of BONUS (perhaps the closer to the median, the higher the reward). The winners will receive an increased BONUS amount. This reward encourages people to vote and do it based on consensus.

- In order to prevent the undervaluation or overvaluation of economically justified seigniorage rates, people whose desired rates fall outside the 25 to 75 percentile range should not be rewarded with BONUS.

Ovozlarni tanga egaligiga qarab tortish, median hisob-kitoblarga asoslangan algoritmni tanlash va konsensusga asoslangan mukofot mexanizmini o'z ichiga olgan holda, sxema, agar ulardan biri ovoz berish tangasining 50% dan ko'prog'iga egalik qilmasa, o'zini vijdonsiz ishtirokchilardan himoya qiladi. Ushbu algoritm DBC tangaga egalik qilish printsipida istisno qilinadi - bitta egasi uchun 30% dan ko'p emas.

Implementation

CENTUS pul modeli CENTUS valyutasini qo'llab-quvvatlash va ishonchni ta'minlash uchun mo'ljallangan, ayniqsa valyuta bozori hali ham kichik bo'lsa. Uning asosiy funktsiyalari doimiy likvidlikni saqlash va haddan tashqari o'zgaruvchanlikni kamaytirish uchun USD stabilkoinlarida zaxirani o'z ichiga oladi.

CENTUS aqlli shartnomasi har doim yangi CENTUS tokenlarini sotish yoki mavjudlarini sotib olish va yoqishni taklif qiladi. Bu bozorga CENTUS taklifini aniqlashga imkon beradi, shu bilan birga narxni 0,01 AQSh dollari chegarasigacha cheklash orqali o'zgaruvchanlikni kamaytiradi.

CENTUS tokenlarini sotishdan olingan daromad zaxirada saqlanadi, uning maqsadi valyuta mustaqil ishonchga ega bo'lgan davrda CENTUS qiymatini ta'minlashdir. Zaxiradagi mablag'lar CENTUS aqlli shartnomasiga kerak bo'lganda CENTUS tokenlarini sotib olishga imkon beradi. CENTUS zaxiralari faqat USD stabilkoinlarida saqlanadi.

CENTUS aqlli shartnomasidan ko'proq tokenlar sotib olinsa, shartnoma ko'proq tangalar chiqaradi; tokenlar qaytarib sotilganda, ular 50% minimal darajaga yetguncha zahiradan qaytarib olinadi, shundan so'ng BILLEX auktsioni boshlanadi.

CENTUS hajmi senyorajning doimiy hisoblanishi bilan oshganda, CENTUSning umumiy kapitallashuvi oshadi, garchi nominal narxda tokenlarning umumiy qiymati CENTUS zaxirasidan oshib ketadi. Natijada, CENTUS zaxirasida CENTUSning to'liq bozor kapitallashuvi (kapitalizatsiyasi) mavjud emas. Boshqacha qilib aytganda, CENTUS zaxira koeffitsienti 100% dan kam.

CENTUS kontekstida 100% dan kam bo'lgan zaxira nisbati tushunchasi tushunmovchiliklarga yo'l qo'ymaslik uchun qo'shimcha tushuntirishlarni talab qiladi. Misol uchun, 95% zahira koeffitsienti CENTUS emissiyasi daromadining 95% zaxiraga qo'yiladi, qolgan 5% esa boshqa foydalanish uchun zaxiradan olinadi, degani emas. Daromad har doim to'liq zaxiraga qo'yiladi; the decrease in the reserve ratio is due to the fact that the CENTUS contract awards seigniorage to token owners 2 times a week, increasing the supply of coins in the hands of owners. In other words, it is the CENTUS owners who benefit when our model reduces the reserve ratio – by increasing the number of their tokens.

Xuddi shunday, 95% zaxira nisbati CENTUS shartnomasi CENTUS tokenlarining atigi 95 foizini qaytarib sotib oladi va to'lovga qodir bo'lmaydi, degani emas. Buning o'rniga, aqlli shartnoma, zahira darajasi 50% ga yetganda, BILLEX chegirmali auktsionini boshlaydi va ularni CENTUS egalariga tokenlari evaziga chegirma bilan sotadi, bu esa veksellar keyinroq to'langanda foydaga aylanadi. Shunday qilib, shartnoma har doim istalgan miqdordagi CENTUS tokenlarini sotib olish imkoniyatiga ega.

CENTUS pul modeli asosan algoritmlarga asoslangan. Barcha CENTUS loyihasi tokenlari Stellar blokcheynida chiqariladi va muomalaga chiqariladi.

Bu foydalanuvchilarga va'da qilingan narsalar haqiqatda bajarilishini shaffof tarzda kafolatlaydi. CENTUS modelida ishtirokchilarga CENTUS taklifini aniqlash imkonini beruvchi likvidlikni ta’minlash mexanizmimiz juda muhim hisoblanadi, shuning uchun u blokcheyn yordamida amalga oshiriladi. Biz to'liq markazlashmagan yondashuvdan foydalanamiz, shuning uchun ishtirokchilar bizning modelimizning kodga asoslangan elementlari aniq ta'riflanganidek amalga oshirilganligiga ishonch hosil qilish uchun hech kimga ishonishlari shart emas.

CENTUS modelining barcha komponentlari kompyuter kodiga asoslanmagan. CENTUS faoliyatining bir qismi zaxiralarni boshqarish va hamkor bonuslarini berish kabi blokcheyn bilan o'zaro aloqani o'z ichiga oladi.

Biroq, amalga oshirish blokcheyndan tashqarida sodir bo'lganda ham, biz CENTUS egalarini bunday jihatlar haqida xabardor qilib, blokcheynning shaffofligini iloji boricha taqlid qilishga intilamiz.

In an ever-changing world, the CENTUS currency cannot rely on a static model. Code-based elements of our model may sometimes need to be modified. Other changes, such as working with new regulatory requirements, cannot be implement- ed through software algorithms. To keep up with the times successfully, the CEN- TUS currency must have a system for making decisions. It is also possible that we will use two blockchains, Stellar and Ethereum, in the work on smart contracts.

When the seigniorage is distributed among CENTUS owners, the number of tokens increases. As a result, the CENTUS reserve – the total net income from the sale of CENTUS tokens – contains less money than the market capitalization of CENTUS – the value of all CENTUS tokens in circulation.

Zaxira koeffitsienti CENTUS zaxiralari bilan ta'minlangan CENTUS bozor qiymatining ulushi sifatida aniqlanadi. Bu zaxiradan qat'i nazar, bozorning CENTUS valyutasiga bo'lgan ishonch darajasini aks ettiradi.

For example, when people buy CENTUS knowing that the CENTUS reserve contains only 80% of the CENTUS market value, this is because they believe that CENTUS also has its own intrinsic value; otherwise, they sell CENTUS back to the CENTUS smart contract. Confidence in the independent value of CENTUS should be even higher if CENTUS are traded in the market when the reserve ratio is lower – say, 50%. In this case, the inherent value of CENTUS – its usefulness as a currency, its authority and recognition – is half its total value.

Zaxira nisbati, shuningdek, CENTUS aqlli shartnomasi CENTUS narxiga qanchalik ta'sir qilishi mumkinligini ham aks ettiradi. Zaxira koeffitsienti yuqori bo'lsa, CENTUS likvidlik funktsiyasi narxlarning o'zgarishini yumshatish uchun ajoyib qobiliyatga ega. Zaxira nisbati pastroq bo'lsa, CENTUS qiymati yanada aniqlanadi va shuning uchun bozor ishonchiga bog'liq; narx harakatini barqarorlashtirishda zaxira kichikroq rol o'ynaydi.

Zaxira nisbati 100% dan kam bo'lsa ham, CENTUS zaxirasi har doim to'lov qobiliyatini saqlab qoladi. Kimdir CENTUS tokenini aqlli shartnomaga qaytarib sotganda, oxirgi token chiqarilganda zaxiraga qo'yilgan pul sotuvchiga o'tadi.

The CENTUS monetary model is based on a variable reserve balance. It remains equal to 100% for the first 100 million tokens. At this stage, CENTUS is fully backed up. The CENTUS value is fixed and does not take into account changes in market confidence. Then, when more CENTUS are issued, the reserve ratio gradu- ally decreases, taking into account the increased confidence of the CENTUS market. The reserve ratio is slowly falling to a minimum of 10% when CENTUS market capitalization reaches US $ 1 billion.

Finally, after CENTUS capitalization reaches significant figures, it will no longer make sense to focus on the reserve in assessing the CENTUS value. The new stable system, which adjusts itself as necessary, will support the existence of CEN- TUS as an independent currency.

Shu munosabat bilan, bizning modelimiz boshqa valyutalar evolyutsiyasini simulyatsiya qiladi: to'liq moddiy aktivlar bilan ta'minlangandan (masalan, oltin standarti); fraksiyonel zaxiralarga; faqat uning boshqaruv organi standartiga asoslanadi.

CENTUS zaxirasi faqat AQSh dollaridagi barqaror tangalarda saqlanadi, uni hech qanday joyga investitsiyalash mumkin emas va faqat aqlli shartnoma yoki Stellar bozorida (DEX) CENTUS sotib olish uchun xizmat qiladi. Agar zaxira hisobvarag'i talab/taklif spredidan daromad olsa, CENTUSni qo'llab-quvvatlash uchun foydalanilgan bu daromad CENTUS zaxirasiga kiritiladi.

CENTUSning keyingi rivojlanishi

Universal basic income (UBI) is a state or other institutional material support for community members. Universal (guaranteed) income consists in the absence of additional (along with belonging to the society) requirements for receiving assistance. It is believed that such a support system can reduce financial anxiety and improve mental and physical health, increase motivation to work. Typical arguments against a decrease in the desire to work and a corresponding decrease in productivity.

Bu davlat yoki boshqa muassasa tomonidan jamiyatning har bir aʼzosiga maʼlum miqdordagi pulni muntazam toʻlashni nazarda tutuvchi ijtimoiy tushunchadir (bunday muassasa ushbu hujjatda CENTUS senyoraj tarmogʻi tomonidan taqdim etilgan).

Umumjahon asosiy (shartsiz) daromad - bu asosiy xarajatlarni qoplash uchun etarli bo'lgan muntazam to'lovlar: ijara, oziq-ovqat va kiyim-kechak. Ular muntazam ravishda, bepul, hech qanday qarshi majburiyatlarsiz taqdim etiladi va yosh, oilaviy ahvol yoki daromad darajasiga bog'liq emas.

Dastlab, davlat va shaxs o'rtasidagi o'zaro munosabatlarning bu usuli haddan tashqari ijtimoiy tengsizlikni bartaraf etish nuqtai nazaridan ko'rib chiqildi. Bu asosiy maqsad edi. Va iqtisodiy fon sifatida ular shunday tushunchadan foydalanganlar “social dividends”. It was introduced by Clifford Douglas, British major, who was convinced that every citizen is entitled to a part of the national wealth.

Everything looks quite logical: if you are a citizen of the country, then you also own part of the national wealth. It is like being a shareowner and receiving a part of the company’s profit in the form of dividends.

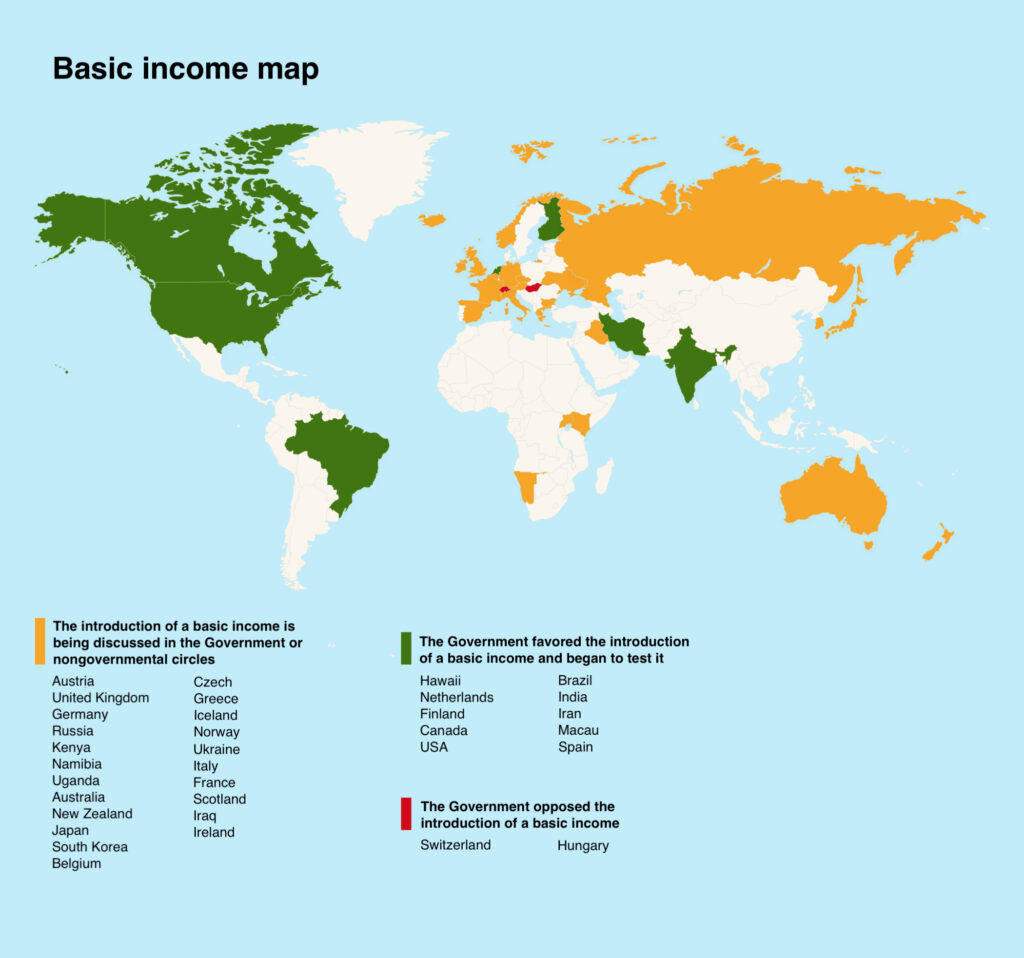

Turli mamlakatlarda UBIning davriy to'lovlarini joriy etishga urinishlar aholini ijtimoiy-iqtisodiy qo'llab-quvvatlashning ushbu chorasi muxoliflari va tarafdorlarining munozaralari va qarama-qarshiliklari bilan birga keladi.

Taking into account different approaches, states are trying to replace social payments with monthly accruals of UBI, thereby giving to the society the right to dispose its income based on its needs. However, it was calculated that, if Switzerland had introduced such kind of social benefits, the expenditure for the introduction of this measure would have been about 200 billion dollars per year. Given the financial condition and small population of this country, this figure is significant even for them.

Hozirgacha universal daromadlarni to'lashning asosiy manbalari quyidagicha nomlandi:

- Umumjahon asosiy daromad barcha mavjud ijtimoiy imtiyozlarni almashtirishi kerak.

- Yuqori soliqlar. Bu yangilik emas, endilikda barcha ijtimoiy dasturlar davlat tomonidan soliqlar hisobiga amalga oshirilmoqda. Shunga qaramay, hozirgi vaqtda ijtimoiy nafaqalar va soliqlar nosimmetrik emas, ya'ni soliqlarni kimlardir to'laydi, nafaqalarni esa boshqalar oladi. Progressiv soliq stavkasi pulni eng boylardan eng kambag'allarga qayta taqsimlash uchun mo'ljallangan.

Nega ishlayotganlar ishlamayotganlarni qo‘llab-quvvatlashi kerak, yoki jamiyat fikricha, yetarlicha ishlamayapti, degan haqoratlarni tez-tez eshitishimiz mumkin. Biz nima deb javob bera olamiz? Bu butun jamiyat manfaatlariga mos keladi. Hech bo'lmaganda, iqtisodchilar va sotsiologlar bu haqiqatni shunday izohlaydilar.

Qolaversa, ijtimoiy qatlamlar o‘rtasida boshqa vositalar bilan mablag‘larni qayta taqsimlash ham qiyinlashmoqda.- Umumjahon bazaviy daromadni to'lashning yana bir manbasi byurokratiyani kamaytirish uchun tejalgan mablag'lardir. Axir, ijtimoiy to'lovlar bilan shug'ullanadigan mansabdor shaxslar endi kerak bo'lmaydi. Har bir fuqaro o‘ziga tegishli bo‘lgan summani har oyda oddiygina oladi.

- Umumjahon bazaviy daromadni to'lash uchun mablag'larni olish variantlaridan biri bu senyoraj (pul muomalasidan olingan va emitent tomonidan mulk huquqi bo'yicha tayinlangan daromad).

Bir qator mamlakatlar UBI hisob-kitob siyosatini muvaffaqiyatli amalga oshirdi.

Kanada

Umumjahon asosiy daromadni to'lash bo'yicha birinchi tajribalardan biri 70-yillarda Daupin shahrida (Kanada) bo'lib o'tgan. Loyiha Mincome deb ataladi. Loyihaga ko‘ra, har bir shahar aholisi 5 yil davomida oylik to‘lovlarni olib turardi. Tan olishimiz kerakki, bu davlat hisobidan tashkil etilgan eng uzoq tajribalardan biri edi.

Manitoba universiteti iqtisodchisi Evelin Forget ushbu tajriba natijalarini o'rganib chiqdi. U o'z hisobotida bandlik darajasi umuman pasaymaganini ta'kidladi. Shu bilan birga, ko‘ngillilar soni ortib, aholining ijtimoiy faolligi oshdi.

Shaharda kasalxonaga yotqizish darajasi 8,5 foizga kamaydi. Tajriba davomida ko'proq o'smirlar maktabni tugatmasdan, maktabni tugatdi.

Namibiya

A coalition of organizations launched a pilot project in Ochivero village, Namibia, with a population of about 1,000 people. For a year, each resident of the village had received 100 Namibian dollars per month. As a result, men stopped illegal hunting, children were not starving, and many children improved their school performance. Employment increased by 11% as people opened pastry shops, hair-dressing salons and brick-making workshops. Additionally, crime rates dropped by 42%.

Hindiston

2011 yilda YuNISEF tomonidan qo'llab-quvvatlangan tadbirkor ayollar uyushmasi bir yarim yil davom etgan tajriba o'tkazdi. 10 ta qishloqdagi har bir kattaga 200 so‘mdan, bolaga esa 100 so‘mdan oylik to‘lanardi. Iqtisodiy faollik ortdi, oziq-ovqat va maktabga qatnashish yaxshilandi. Hindiston hukumati eksperiment natijalarini hisobga olib, 29 xil ijtimoiy dasturlarni fuqarolarga to‘g‘ridan-to‘g‘ri to‘lovlar bilan almashtirdi.

In addition, this year, Arvind Subramanian, an economic adviser to the government of India, suggested that the introduction of unconditional income at the national level should be considered. In the annual report for the government, the estimated amount was also named – 7620 rupees or $113 per year. Even such a small amount, according to many, could significantly reduce the level of poverty in the country.

Germaniya

2014 yilda germaniyalik tadbirkor Maykl Bomeyer pilot dasturni amalga oshirishni boshladi “Mein Grundeinkommen” (my basic income). Several dozen randomly selected people had been receiving 1,000 euros each month for a year.

Loyihaning barcha ishtirokchilari uyqulari ancha tinchlanganini ta'kidlamoqda. Biroq, umuman olganda, ularning hayotida ko'p narsa o'zgarmadi, chunki talabalar o'qishni davom ettirdilar, ishchilar ishlashni davom ettirdilar.

Loyiha muallifi taʼkidlaganidek, asosiy toʻlovlar gʻoyasi toʻrt tamoyilga asoslanadi: u universaldir, u individual muammolarni hal qiladi, hech qanday sharoitga bogʻliq emas va fuqarolar uchun yuqori minimal turmush darajasini yaratadi.

Ko'pgina mamlakatlar o'rtada “experiment” now. We will be able to evaluate the results only after some time. You can find few examples of these countries below.

Finlyandiya

Finlyandiya milliy sug'urta organi daromad darajasidan qat'i nazar, mamlakatning barcha voyaga etgan fuqarolari uchun ijtimoiy nafaqalarni qat'iy belgilangan to'lov bilan almashtirishni taklif qildi. To‘lovlarni oyiga 550 yevro qilib belgilash, keyinroq esa 800 yevroga ko‘tarilishi kutilmoqda.

Keniya

2016 yil oktyabr oyida Sharqiy Afrikada qashshoqlikka qarshi kurashuvchi Nyu-Yorkda joylashgan Givedirect xayriya tashkiloti Keniyada universal asosiy daromadni to'lash bo'yicha hozirgacha eng yirik loyihani ishga tushirdi. 40 ta qishloq aholisi 12 yil davomida oyiga taxminan 22,5 dollar oladi. Bu nafaqat xayriya tadbiri, balki universal asosiy daromadning samaradorligi to'g'risidagi ma'lumotlarni to'plash va tahlil qilishga qaratilgan ilmiy tajribadir.

AQSH

Participants of the Economic Security Project, launched at the end of 2016, are researching the potential benefits of universal basic income in developed economies. The initiators of the project with a budget of 10 million dollars are more than 100 organizations and individuals, including Chris Hughes, Facebook cofounder, and Sam Altman, Y Combinator Foundation President.

Ispaniya

Koronavirus pandemiyasining ijtimoiy va iqtisodiy oqibatlarini yumshatish chora-tadbirlari doirasida Ispaniya hukumati yaqin kelajakda universal bazaviy daromadni joriy qilmoqchi. Bu haqda 2020-yil 5-aprelda Iqtisodiyot vaziri Nadiya Kalvino ma’lum qildi. Ispaniya hukumati epidemiyadan keyin ham universal asosiy daromadni saqlab qolmoqchi. Iqtisodiyot vaziri universal asosiy daromad "doimiy tarkibiy vosita" bo'lib qolishiga umid bildirdi.

Dunyoda universal daromadni to'lash bilan bog'liq 20 ga yaqin tajribalar mavjud. Olimlar bizni och qolmasdan ishlashni davom ettirish uchun yetarli darajada g'ayratli ekanligimizni aniqlashga harakat qilmoqda.

Any member of the CENTUS seigniorage network, a coin owner, is entitled to receive basic income in the form of interest accrued on the amount of coins in his wallet. The basic income rate is determined by network participants – owners of DBC tokens intended for project management. This is done to prevent CENTUS coin owners from indefinitely inflating the interest paid, thus no excessive supply of coins is created on the market.

CENTUS seigniorage tarmog'ida nafaqat tanga sotib olgan ishtirokchilar asosiy daromad olishlari mumkin. Tokenlarni sotib olish imkoniyati bo'lmagan jamiyat a'zolari ham bunday daromad olishlari mumkin. Buning uchun ishtirokchilar CENTUSga aylantirib, asosiy daromad olishlari mumkin bo'lgan maxsus bonuslarni olish va to'plash orqali loyihani ma'lum bir bosqichda ilgari surishlari mumkin. Albatta, ular bu tangalarni istalgan qulay vaqtda sotishlari mumkin.

Kelajakda loyihaning rivojlanishi va CENTUS kapitallashuvi ortib borishi bilan foiz to'lovlaridan tashqari, mutlaq ko'rsatkichlarda, masalan, 50-100 AQSh dollaridan bir necha yuz AQSh dollarigacha bo'lgan minimal belgilangan miqdorni to'lash rejalashtirilgan. har bir CENTUS ishtirokchisiga.

At the initial stage, we reserve the right to use any combination of seigniorage (basic income) payments, including dividing accruals depending on how CENTUS was received: for example, those who purchased tokens at their own expense can count on the maximum payout, while those who received them through bonus and other exchanges, as well as various incentive programs can receive accruals par- tially.

People living in developed countries take for granted the availability of a stable currency. If you are in the US with unlimited access to dollars or in the EU with access to euros, you may wonder why the world needs a digital currency with a stable price. However, in countries with weak financial institutions and unstable currencies, high rates of inflation and currency devaluation are common. We expect CENTUS with its stable price and integral seigniorage to be in high demand in these markets.

At the time of publication in the second quarter of 2020, annual inflation in Egypt was 6.8%, in Argentina – 50.3%, and in Nigeria – 12.2%. These are only those countries whose governments are relatively more stable. Let us look at Venezuela, which currently has an annual inflation rate of 9586%. What would you do if your savings were disappearing at a rate of 9586% a year? Faced with a rapidly depreciating local currency, people are looking for other ways to survive, often leaning towards the dollar. This effect is known as dollarization.

It usually takes three forms:

- Birinchidan, aholi mahalliy hukumat tomonidan hech qanday muvofiqlashtirishsiz mahalliy valyuta o‘rniga dollardan foydalanishni afzal ko‘rishi mumkin. AQSH dollari de-fakto valyuta sifatida Markaziy Osiyo va Afrikaning janubi-g‘arbiy qismidagi bir qator mamlakatlarda qo‘llaniladi va rasmiy muvofiqlashtirish yo‘qligiga qaramay, uni qabul qilish darajasi nihoyatda yuqori bo‘lishi mumkin. Misol uchun, 2006 yildan 2008 yilgacha bo'lgan 2 yil davomida Seyshel orollarida dollarizatsiya 20% dan 60% gacha ko'tarildi.

- Ikkinchidan, mamlakat fuqarolari dollarni uning chegaralari orqali harakatlanishiga to'sqinlik qiladigan davlat kapital nazoratiga qaramay, dollar talab qilishlari mumkin. Hech kimga sir emaski, Argentinada 2011 yildan 2015 yilgacha kapital nazorati davrida dollar ko'k deb nomlanuvchi qora dollar bozori mavjud edi. O'sha yillar davomida kuniga 10 dan 40 million dollargacha bo'lgan stavkalar 25 ga teng edi. -rasmiy kursdan 30% yuqori. Ushbu tikishlar rasman noqonuniy bo'lishiga qaramay, hatto har kuni milliy gazetalarda chop etilgan.

- Uchinchidan, valyuta devalvatsiyasi shu qadar kuchli bo'lishi mumkinki, hukumatlar 2009 yilda Zimbabveda bo'lgani kabi rasmiy ravishda AQSh dollariga o'tishlari mumkin. Bugungi kunda butun mamlakat jismoniy qog'oz dollar va tangalarni muntazam yetkazib berishni talab qiladi.

The prospects are obvious. Regardless of whether dollarization is officially approved, citizens, banks, and governments incur significant costs when importing physical US dollars. CENTUS, which allows millions of dollars to be transported by making the phone call and generates regular income, seems to be a significantly better alternative to paper dollars in all dollarization scenarios.

In conclusion: existing digital currencies have found an appeal in some countries with hyperinflation, for example, the use of bitcoins in Venezuela is growing as the country has faced a currency crisis. However, Bitcoin can never truly free people from their unstable local currency due to the lack of quote stability. For example, if bitcoin goes through a devaluation cycle, users do not see the difference between devaluing bitcoin and devaluing the local currency. Even if bitcoin only crashes once, people will want to switch to an alternative that is stable in price – if such option exists. Thus, the CENTUS seigniorage stablecent, which allows you to receive regular income, will be an excellent solution for developing countries experiencing rapid currency devaluation.

Bugungi kunda kripto bozori treyderlarining ko'plab ishtirokchilari kriptovalyuta bozorlarida notinchlik yuzaga kelganda o'zlarining kriptovalyutalarini AQSh dollariga bog'langan barqaror tangalarga aylantiradilar. Ushbu ehtiyojni qondirish uchun USD Tether deb nomlanuvchi markazlashtirilgan yechim yaratildi, ammo keyinroq muhokama qilinadigan sabablarga ko'ra Tether kabi markazlashtirilgan yechim uzoq muddatda ishlamaydi va natijada Tether jiddiy muammolarga duch keldi. salbiy kayfiyat. Bundan tashqari, bozor tushib ketganda va treyder o'z aktivlarini USD Tether kabi oddiy barqaror tangada saqlasa, u barqaror narxga ega va shu bilan birga daromad keltiradigan CENTUSdan farqli o'laroq hech qanday foyda olmaydi (senyoraj) uning egasiga.

Barqaror narxga ega senyoraj raqamli valyuta raqamli treyderlarning ehtiyojlarini qondirishi mumkin. Shu sababli, kriptovalyuta treyderlari tabiiy ravishda yangi protokollar haqida g'ayratli bo'lishlari mumkin va bu erda biz CENTUS Stable Centga dastlabki talabni kutmoqdamiz.

CENTUS o'z egasiga o'sish bosqichida senyoraj ko'rinishida foyda keltiradigan raqamli valyutani va AQSh dollariga bog'langan barqaror tangani birlashtiradi.

Due to instability, today’s cryptocurrencies are not suitable for even the most basic financial contracts that our economy relies on. Can you imagine a job for which you get one bitcoin per month, but you pay all your monthly bills in US dollars – what will happen to you and your family if the price of BTC falls? How about buying a home with a 30-year mortgage denominated in bitcoin, in a world where you probably still get paid in dollars? It is impossible to predict the development of events in such cases, because the credit and debt markets, and in fact the markets for any financial contract over time depend on price stability.

Ipoteka shartnomasini tuzayotganda, siz qarz beruvchi sifatida oladigan eng katta xavf - bu defolt xavfi. Ammo, agar bu ipoteka Bitcoin kabi beqaror aktivda ifodalangan bo'lsa, siz ham juda yuqori narx xavfiga duch kelasiz. Misol uchun, agar Bitcoin narxi keyingi 30 yil ichida istalgan kunda 90% ga tushib qolsa, 30 yillik bitkoinli ipoteka narxi birdaniga juda past bo'lishi mumkin. Bitimlarni amalga oshirish uchun siz taqdim etgan har bir kredit uchun Bitcoin narxini taxmin qilishga tayyor bo'lishingiz yoki buni amalga oshiradigan mutaxassisni topishingiz kerak. Qanday bo'lmasin, qarz oluvchi sizning narx risklarini himoya qilishga tayyorligingiz uchun to'lashi kerak. Bu eng oddiy moliyaviy shartnomalarga muzokara qilish qiyin bo'lgan jihatlarni qo'shadi.

Blockchain sanoatidagi bir qator vizyonerlar biz yaqinda markazlashtirilmagan vositalar bilan mavjud xizmatlarni amalga oshiradigan "blokcheyn ilovalari" ekotizimini ko'rishimizga ishonishadi. Misol uchun, bir kun biz ko'rishimiz mumkin “Uber blockchain” yoki “Airbnb blockchain”, each using its own tokens. In fact, this is already happening with Filecoin, a service for decentralized file storage on the Internet.

Albatta, agar har bir blokcheyn ilovasi o'z tokenini yaratsa, unda konversiya tizimi bo'lishi kerak “a universal token that during its holding brings a constant income and has 100% liquidity” and the tokens of any of these applications. We assume that each person will become a owner of a universal token and will pay with it when using any blockchain application. Then, after payment, the universal token will be immediately converted into an app token at the market rate. This will be similar to your bank account in US dollars and using your debit card in another country, such as Spain, in which case your bank converts your US dollars to euros at the market rate every time you make a purchase, without having to think about it. At the same time, you also get a regular basic in- come in the form of a seigniorage for tokens.

Agar universal tokendan foydalanishni talab qiladigan blokcheyn ilovalarining ushbu ekotizimi mavjud bo'lsa, bu universal token muntazam ravishda olinadigan daromad sharti bilan narxda barqaror bo'lmasa, juda g'alati bo'lar edi. Boshqacha qilib aytadigan bo'lsak, agar siz blokcheyn ilovalarining kelajagiga ishonsangiz, almashinuv uchun nafaqat barqaror narx tangasi talab qilinishiga ishonishingiz, balki barqaror narx tangasi muvaffaqiyatli bo'lishiga umid qilishingiz kerak.

Annex

White Paper – documentation that describes the project, new process, or algorithm in detail. It is part of the company’s content strategy. Its purpose is to provide useful information about solving a particular problem.

Token, raqamli token - kriptovalyuta muhitida nomoddiy aktivga, muayyan xizmatlarga kirish imkonini beruvchi vositaga yoki ichki valyutaga murojaat qilish uchun ishlatiladigan atama.

Cryptocurrency – yaratish va nazorat qilish kriptografik usullarga asoslangan raqamli valyuta turi. Qoida tariqasida, kriptovalyutalarning rekord tizimi markazlashtirilmagan. Ushbu tizimlarning ishlashi blokcheyn texnologiyasiga asoslangan. Tranzaksiya ma'lumotlari odatda shifrlanmaydi va hamma uchun ochiqdir. Kriptografik elementlar tranzaktsiyalar blok zanjiri ma'lumotlar bazasi o'zgarmasligini ta'minlash uchun ishlatiladi (ochiq kalit tizimiga asoslangan raqamli imzo, ketma-ket xeshlash).

Blockchain – ma'lumotni (bitimlar, bitimlar va shartnomalar to'g'risida) o'z ichiga olgan ma'lum qoidalarga muvofiq qurilgan bloklarning uzluksiz ketma-ket zanjiri (bog'langan ro'yxat). Blok zanjirlarining nusxalari turli xil kompyuterlarda mustaqil ravishda saqlanadi va qayta ishlanadi. Ko'pincha blokcheyn turli kriptovalyutalardagi operatsiyalar haqida ma'lumotni o'z ichiga oladi, ammo bloklar boshqa ma'lumotlarni ham o'z ichiga olishi mumkin.

Decentralization – yagona markazsiz butun tizim bo'ylab funktsiyalarni taqsimlash jarayoni. Markazlashtirilmagan tarmoq (Peer-to-peer Network) - bu ishtirokchilarning teng huquqliligiga asoslangan kompyuter tarmog'i. Ko'pincha bunday tarmoqda ajratilgan serverlar mavjud emas va har bir tugun (tengdosh) mijoz bo'lib, bir vaqtning o'zida server vazifasini bajaradi. Ushbu tashkilot har qanday raqam va mavjud tugunlarning istalgan kombinatsiyasi bilan tarmoq ish faoliyatini saqlab qolish imkonini beradi.

Aqlli shartnoma - hisoblash tizimlarida ma'lum hodisalar yuzaga kelishiga sabab bo'ladigan shartlar to'plamini tavsiflovchi dastur kodi. U blokcheyn texnologiyasida tijorat shartnomalarini tuzish va ularga xizmat ko'rsatishni texnik amalga oshirish uchun mo'ljallangan.

Yulduzli – valyutalar va to'lovlar uchun ochiq manba tarmog'i. Dasturiy ta'minot markazlashtirilmagan ochiq tarmoqda ishlaydi va har kuni millionlab tranzaktsiyalarni qayta ishlaydi. Stellar tarmoqni sinxronlashtirish uchun blokcheynga tayanadi.

Yulduzli manzil – kriptovalyutani yuborish / qabul qilish uchun noyob belgilar to'plami. Tarmoqdagi manzillar takrorlanmaydi. Manzil, shuningdek, bloklarni imzolash uchun ishlatiladigan ochiq kalit vazifasini ham bajaradi.

Fiat money – nominal qiymati davlat tomonidan belgilanadigan va kafolatlangan oddiy pullar (dollar, evro, rubl).

The purpose of this White Paper is to provide information about the CENTUS project to potential buyers of CENTUS stable cent, DBC token, BILLEX token on the basis of which it will be possible to make a purchase decision. The information provided in this document is not exhaustive and does not imply any contractual obligations and can only be considered as marketing information about the project. The project information in this document is subject to change, update without prior notice and cannot be considered as a form of obligations of CENTUS, as well as related legal entities that support the project. CENTUS reserves the right to change the text of this document without any prior notice and at any convenient time.

Ushbu hujjatdagi hech narsa har qanday turdagi investitsiya taklifi sifatida talqin qilinishi mumkin emas. Bu taklif har qanday yurisdiktsiyada qimmatli qog'ozlarni sotish yoki sotib olish taklifi emas. Ushbu hujjat pul birjasida ishtirok etish uchun etarli huquqiy qobiliyatga ega bo'lmagan jismoniy shaxslar va kompaniyalarga tokenlarni sotib olishni taklif qilmaydi.

Agar siz CENTUS loyihasida ishtirok etish huquqiga ega ekanligingizga ishonchingiz komil bo'lmasa, professional yuridik, moliyaviy, soliq yoki boshqa maslahatchi bilan bog'lanishingiz kerak. CENTUS loyihasida ishtirok etish ixtiyoriydir.

CENTUS Stable Centni yaratishga bizni nima ilhomlantirdi?

Bazis - bu kursni ushlab turish uchun tangalarni etkazib berishni ko'paytirish va kamaytirish g'oyasini ham taqdim etgan loyiha. Basis 2017-yilda ishga tushirilgan va 2018-yil oxirida yopilgan, yig‘ilgan 133 million dollar mablag‘, maslahatchilarning ta’sirchan ro‘yxati va kuchli jamoa. Sababi, AQSh qonunlariga ko'ra, ularning tokenlari qimmatli qog'ozlar hisoblanib, qimmatli qog'ozlar uchun cheklovlarga duchor bo'lgan.

Bizga Basis loyihasi haqida ko'p narsa yoqadi va bu hujjat asosan ularning Oq qog'oziga tayanadi. Biz undan eng yaxshisini olishga qaror qildik, lekin barcha CENTUS tokenlari egalariga senyoraj toʻlovini qoʻshish orqali sxemani yaxshiladik, shuningdek, ishtirokchilar uchun marketmeyker vazifasini bajaradigan, CENTUS-dan foydalangan holda sotuvchi va sotib oladigan aqlli shartnomaga qisman zaxirani qoʻshdik. zaxiralar.

Biz Basisning huquqiy muammolarini inobatga oldik va obligatsiyalar o'rniga BILLEX veksellarini taklif qildik, ishtirokchilarning o'zlari CENTUS evaziga aqlli shartnoma orqali tuzadilar. Bunday holda, qonunchilik muammosi to'liq hal qilinadi, chunki har qanday jismoniy yoki yuridik shaxs litsenziyaga ega bo'lmasdan veksellarni chiqarishi mumkin, chunki veksellarni chiqarish Buyuk Britaniyaning veksellar to'g'risidagi qonuni (1882) bilan tartibga solinadi, unda aniq ko'rsatilgan. ularni chiqarish va muomalaga kiritish tartibi. CENTUS Protocol faqat ishtirokchilarga CENTUS doirasida BILLEX chegirmali veksellarini chiqarish uchun qulay platformani taklif etadi. Bundan tashqari, qisman zaxiralangan CENTUS tizimi majburiy 100% xavfsizliksiz ta'minotni ko'paytirishga imkon beradi, bu esa, ayniqsa rivojlanishning birinchi bosqichlarida taklifni ko'paytirish siyosatida ko'proq moslashuvchanlikni ta'minlaydi.

Bitkoin tranzaktsiyalardan foydalanish uchun AQSh dollari bilan raqobatlasha boshlagan dunyoni tasavvur qiling. Siz bitkoinlarda to'laysiz, lekin ijara haqini dollarda to'laysiz yoki aksincha. Bitcoinning o'ziga xos o'zgaruvchanligini hisobga olsak, bu mantiqiy emas.

This article has presented CENTUS — a reliable, decentralized implementation of digital currency with a stable price and regular seigniorage for coin owners. We believe that if we can just make sure that the purchasing power of the currency does not change, people will give up the idea that it is not worth having a lot of digital currencies, and come to the understanding that storing their savings or incomes in CENTUS Stable Cent is reliable and profitable. We believe that this feature will help our tokens pass the acceptance cycle and help them move to the main exchange environment – a result that no other digital currencies has yet managed to achieve.

Agar sizda biron bir fikr bo'lsa yoki loyihada ishtirok etishni xohlasangiz, sarlavha sahifasida ko'rsatilgan mualliflarga yozing. Ushbu hujjatning eng so'nggi versiyasini olish uchun veb-saytga tashrif buyuring http://www.centus.one