Buku Putih CENTUS

pengantar

Banyak mata uang digital telah dihasilkan di dunia modern dan digunakan sebagai uang kuasi. Cryptocurrency seringkali memiliki fungsi yang sama dengan uang yang dikeluarkan pada tingkat regulasi negara, dan bertindak sebagai alat perantara dalam pertukaran komoditas.

Sama seperti uang yang dikeluarkan negara (fiat), mata uang digital mengalami tahap perkembangan berkelanjutan yang lengkap seiring dengan proses perkembangan masyarakat yang tiada akhir:

– Fast response to scientific and technological progress. All engineering and technological achievements are implemented in the money production process.

– Increase in the speed of money circulation, and, as a result, the speed of payments. In turn, this trend is limited in the growth of the payment acceleration price (the growth of commission for conducting and other costs) and its security (ambition to minimize the risk of losing money during the payment).

– Increased availability of payment tools and controllability of the funds transfer process. Enterprises and buyers strive to use the most affordable and simple payment tools.

Namun, dengan semua keuntungan nyata menggunakan mata uang digital dalam sistem penyelesaian, penyimpanan dan penggunaan cryptocurrency dalam kehidupan sehari-hari, mereka belum menerima aplikasi massal baik dalam bisnis maupun di tingkat konsumen. Kami percaya ini terkait dengan masalah berikut:

Masalah No. 1: Cryptocurrency sulit dimengerti

Masalah No. 2: Ketidakstabilan dan volatilitas

Isu No. 3: Kurangnya regulasi hukum dan teknis

Masalah No. 4: Tidak ada cara untuk menampilkan mata uang digital ke dunia nyata

Private issuers who issue their digital currencies for various purposes carry out informing and training of users on the cryptocurrency market, helping them to understand its nature and ways of using it. The infrastructure required for effective operation is developing at the right pace to solve the problem of cryptocurrency output to the real world. However, in order to make a typical purchase or exchange operation and get the result in the form of real goods or cash, the user needs to use the services of several companies, each of them requires additional time to conduct the transaction and high costs in the form of commissions. At the intersection of two – cryptocurrency economy and classical economy, the problem of developing a single solution has become more urgent than ever.

Volatilitas harga bitcoin (BTC) dan cryptocurrency lainnya adalah salah satu hambatan terbesar untuk adopsi yang meluas. Tidak seperti mata uang kertas (fiat), mata uang digital modern tidak memiliki Bank Sentral yang menerapkan kebijakan moneter untuk menjaga daya beli yang stabil, yang berarti bahwa perubahan permintaan dapat menyebabkan fluktuasi harga yang sangat besar. Jika pengguna tidak dapat memastikan bahwa daya beli akun mereka akan tetap stabil, mereka tidak akan pernah menggunakan mata uang kripto sebagai alat tukar alih-alih aset alternatif yang memiliki nilai stabil. Terlepas dari kenyataan bahwa banyak penelitian telah berfokus pada topik teknis seperti throughput transaksi dan kontrak pintar, dibandingkan dengan mereka, hampir tidak ada perhatian yang diberikan untuk meningkatkan stabilitas harga, dan kami percaya bahwa masalah ini merupakan hambatan yang jauh lebih serius untuk adopsi massal cryptocurrency sebagai alat tukar.

CENTUS dirancang untuk mempertahankan nilai yang stabil, serta untuk menghasilkan pendapatan dasar reguler (seigniorage) bagi pemiliknya, dan merupakan media pertukaran yang tersedia bagi siapa saja yang terhubung ke Internet.

CENTUS adalah mata uang digital yang keandalan tokennya dijamin dengan pasaknya terhadap dolar AS, sambil tetap sepenuhnya terdesentralisasi. Protokol CENTUS secara algoritme menyesuaikan penerbitan token CENTUS sebagai tanggapan terhadap perubahan nilai tukar CENTUS terhadap USD. Hal ini memungkinkan untuk menerapkan kebijakan moneter yang mirip dengan kebijakan bank sentral di seluruh dunia, kecuali bahwa ia menggunakan algoritma terdesentralisasi berdasarkan protokol, tanpa perlu campur tangan manusia secara langsung.

CENTUS dapat menjadi solusi yang mungkin untuk masalah volatilitas mata uang dalam menggunakannya untuk layanan pinjaman dan gaji, atau kontrak keuangan utama lainnya.

Selain itu, perbedaan terpenting antara CENTUS dan stablecoin lainnya adalah pemiliknya menerima penghasilan dasar reguler (seigniorage), dibayarkan setiap minggu (Selasa dan Jumat), langsung ke dompet peserta.

CENTUS dirancang untuk menjaga harga tetap stabil dengan menyesuaikan penawaran secara algoritmik.

Misi CENTUS adalah untuk menciptakan kekayaan dan mendistribusikannya kembali di antara orang-orang sederhana — anggota jaringan Centus Seigniorage.

Stable Cent (CENTUS) adalah mata uang digital stabil algoritmik di blockchain Stellar. Jumlah Stable Cent yang beredar meningkat atau menurun sesuai dengan algoritma yang ditentukan, tergantung pada permintaan di pasar.

100 CENTUS ≈ 1 USD

Dengan memungkinkan peserta untuk membeli dan menjual CENTUS, kontrak pintar berfungsi sebagai pembuat pasar. Untuk membeli CENTUS, peserta perlu mentransfer dana ke alamat kontrak pintar, di mana dana tersebut disimpan sebagai cadangan variabel. Tujuan utama dari cadangan CENTUS adalah untuk memberikan kesempatan kepada peserta untuk menjual token CENTUS mereka kapan saja; kontrak membeli CENTUS menggunakan dana dari cadangan.

Dua kali seminggu, "kontrak pintar" mengeluarkan CENTUS baru dan mendistribusikannya secara proporsional di antara pemegang CENTUS yang ada, dengan mempertimbangkan permintaan pasar.

Hasilnya, pemilik CENTUS menerima pendapatan yang disebut “Seigniorage”.

Seigniorage is the state’s revenue from issuing money. Central banks can influence the level of seigniorage that governments receive by regulating the growth rate of the monetary system.

Kami percaya bahwa distribusi CENTUS di antara pemilik CENTUS yang ada adalah dasar utama stabilitas sistem. Selain itu, kami yakin bahwa komponen spekulatif ini memastikan stabilitas CENTUS.

Ketika seigniorage didistribusikan di antara pemilik CENTUS, koin memiliki dua sumber nilai: sen stabil CENTUS itu sendiri dan seigniorage yang diterima orang dua kali seminggu. CENTUS Stable Cent dipatok ke 1 US CENT (¢). Karena pemilik CENTUS secara teratur menerima seigniorage, biaya CENTUS sama dengan 1¢ + seigniorage.

Kami percaya bahwa jika pelaku pasar mengharapkan pembayaran baru kepada pemilik CENTUS dalam waktu dekat, mereka akan membeli CENTUS untuk alasan spekulatif. Algoritma CENTUS akan menanggapi permintaan yang meningkat ini dengan membuat CENTUS baru untuk mengembalikan harga koin menjadi 1 US CENT.

Meskipun kemungkinan akan mendorong spekulan untuk membeli lebih banyak CENTUS untuk mendapatkan keuntungan dari koin baru ini dan menyebabkan kenaikan buatan dalam waktu lama dan mempertahankan harga di atas 1 sen, algoritme untuk pengurangan seigniorage sambil menaikkan harga di CENTUS akan memiliki efek menguntungkan pada stabilisasi nilai tukar pada tingkat 1 sen sekitar.

Wajar untuk berpikir bahwa mendistribusikan koin baru ke pemilik CENTUS yang ada hanya akan meningkatkan nilai CENTUS, karena hal itu menciptakan komponen spekulatif yang menarik yang memberi penghargaan kepada orang-orang yang menerima CENTUS.

Kami percaya bahwa menambahkan komponen spekulatif ini akan merangsang permintaan konstan, dan seigniorage bunga mengambang hanya akan menambah utilitas CENTUS tanpa mengurangi nilai stabilnya.

Menurut perkiraan kami, ini akan secara signifikan meningkatkan nilai CENTUS nyata dan jangka panjang bagi para pelaku pasar.

CENTUS tidak akan "dicetak" untuk masa depan — setiap unit akan dibuat saat pengguna membelinya, dan dalam kasus pertukaran terbalik — dihancurkan. Dengan demikian, aset yang ditransfer ke cadangan mengamankan saham CENTUS.

CENTUS token is, first of all, not a token for speculation by exchange traders, but mainly a means of accumulation and income generation by simple people – its owners, as well as a means of settlements between them.

Kami tidak mencari pembiayaan eksternal dari investor pihak ketiga, dengan alasan bahwa di masa depan mereka akan menuntut pengembalian yang tinggi sebagai imbalan atas investasi awal, kami sangat percaya bahwa pengembalian yang tinggi ini dapat langsung dikirim ke orang-orang yang membeli CENTUS tanpa perantara pertama ini. .

Protokol CENTUS lebih mudah dipahami jika Anda membandingkannya dengan Federal Reserve (FED). Seperti FED, kontrak pintar CENTUS mengontrol tingkat harga dan menyesuaikan jumlah uang beredar dengan melakukan operasi di pasar terbuka, yang dalam kasus kami terdiri dari pembuatan token CENTUS atau token BILLEX (kami memberi tahu lebih banyak tentang hal itu di bawah). Seperti halnya FED, operasi ini diprediksi oleh teori uang kuantitas untuk menghasilkan tingkat harga jangka panjang pada pasak yang diinginkan.

Likuiditas CENTUS

The CENTUS currency includes a liquidity mechanism designed to mitigate the impact of market forces when they cause volatility in the value of CENTUS. The CENTUS smart contract offers a permanent sale of new CENTUS tokens at a price close to 0.01 US dollars. And vice versa, the contract offers to buy back and destroy CENTUS tokens at a price close to 0.01 dollars. A smart contract allows a spread within which speculative participants can earn profits by maintaining the coin’s peg.

Dengan demikian, pasokan token CENTUS ditentukan oleh permintaan: token dikeluarkan atau ditarik dari peredaran tergantung pada pasar. Selain itu, nilai CENTUS berada di antara harga beli dan harga penawaran. Dalam kisaran yang ditentukan oleh kontrak pintar CENTUS, transaksi dapat dilakukan di pasar sekunder tanpa melibatkan kontrak pintar.

Pendapatan dari penerbitan token CENTUS baru sepenuhnya dicadangkan. Cadangan dibuat semata-mata melalui penjualan token CENTUS, dan satu-satunya tujuannya adalah untuk memberikan kontrak pintar CENTUS kemampuan untuk menebus token, jika perlu. Biaya pemeliharaan cadangan ditanggung oleh cadangan itu sendiri.

About Tokens

These are the main tokens of the system. They are pegged to the US dollar and intended to be used as means of exchange and revenue generation through the distribution of seigniorage among token owners. Their offer increases and decreases in order to maintain a price peg to 0.01 US dollars.

The CENTUS design and development process requires funding. We believe that this process should reflect the values and principles that we want to promote. Since our project declares integrity and low volatility, we did not want to start the development of CENTUS with public speculation through ICO. Accordingly, we decided to use only the founders’ own funds as the first participants of the CENTUS project.

Kami menggunakan token khusus yang disebut Debit Coin (DBC) untuk memberikan kompensasi kepada anggota pendiri awal dan pihak lain yang berkepentingan. DBC adalah token voucher yang dapat dikonversi ke CENTUS sesuka hati. Jumlah CENTUS yang diterima selama konversi telah dimodelkan sebelumnya dan tergantung pada ukuran ekonomi CENTUS: jumlahnya dimulai dari nol dan meningkat hanya jika ekonomi CENTUS mencapai kesuksesan nyata. Hal ini memastikan bahwa kepentingan pemilik DBC tidak bertentangan dengan kepentingan pemilik CENTUS.

Jumlah token DBC sama dengan 100 juta. Pemilik token ini memiliki hak untuk memberikan suara pada tingkat bunga seigniorage yang dibayarkan ketika penawaran ditingkatkan.

DBC memiliki pembatasan bawaan pada dampak ekonomi CENTUS. Tingkat konversi DBC ke CENTUS dibatasi hingga 1:500, sehingga dampak kumulatif pemilik DBC terbatas. Untuk mengurangi pengaruh entitas individu mana pun, ukuran saham juga dibatasi hingga maksimum 30 persen per satu pemilik.

DBC owners will only be able to receive a seigniorage on this asset in case the capitalization of CENTUS gets at least 10 million. After that, as the system grows and the number of CENTUS in circulation increases, the amount of seigniorage for DBC owners will gradually increase from 10% to 50% of the total amount of accrued seigniorage.

Dengan demikian, pemilik DBC menanggung risiko tertinggi. Ini dapat dibandingkan dengan memegang saham biasa dari sebuah perusahaan, sedangkan CENTUS lebih seperti saham preferen, dengan seigniorage "dijamin", tetapi tanpa hak suara dan dividen super.

DBC selalu dapat ditukar dengan CENTUS dengan nilai tukar saat ini. Semakin tinggi tarif DBC, semakin banyak CENTUS yang bisa Anda dapatkan (batas maksimum adalah 500 CENTUS). DBC hanya dapat ditukar satu kali, dan mereka dikeluarkan dari peredaran dan dibakar selama pertukaran.

Diskon tagihan pertukaran di blockchain. Token ini dijual melalui lelang blockchain ketika Anda perlu mengurangi penawaran CENTUS. BILLEX tidak dipatok untuk apa pun, dan setiap tagihan menjanjikan bahwa pemilik mendapatkan tepat satu CENTUS pada titik tertentu di masa depan dalam kondisi tertentu. Karena BILLEX yang baru dibuat dijual di lelang terbuka dengan harga kurang dari satu CENTUS, Anda dapat mengharapkan bonus kompetitif atau “yield” for buying bills when they are redeemed at par.

Ketentuan di mana BILLEX ditukarkan:

- Kontrak pintar menciptakan dan mendistribusikan CENTUS, yang berarti menentukan kebutuhan untuk meningkatkan pasokan CENTUS.

- BILLEX tidak kedaluwarsa, i. itu dibuat kurang dari 1 tahun yang lalu.

- Semua token BILLEX sebelumnya yang dibuat sebelum token BILLEX ini ditebus atau kedaluwarsa.

Interkoneksi token untuk jaminan stabilitas

CENTUS memberikan stabilitas harga menggunakan prinsip ekonomi yang sama dengan yang diandalkan oleh bank sentral di seluruh dunia. Yang paling penting dari ini adalah teori kuantitas uang. Di bagian ini, kita akan membahas topik-topik berikut:

- Bagaimana teori kuantitas uang menghubungkan tingkat harga jangka panjang dengan permintaan dan penawaran uang?

- Bagaimana Protokol CENTUS menilai perubahan permintaan dengan melacak nilai tukar antara CENTUS dan aset yang dipatoknya?

- Bagaimana Protokol CENTUS meningkatkan dan mengurangi penerbitan token CENTUS berdasarkan nilai tukar?

- Menciptakan pasar untuk meningkatkan dan mengurangi pasokan CENTUS.

History shows that in times of rising and falling markets, people often make economically significant decisions under the influence of panic and without regard for common sense. During an economic boom, people have more money, so they want to buy more goods, which leads to higher prices for goods, which encourages demand for higher wages, which means that people have even more money. This phenomenon is known as the inflationary spiral, and this is what happened in Germany in the 20s, Brazil in the 80s and Argentina in the 90s. Similarly, in an economic downturn, people are afraid to buy goods, resulting in lower prices for goods, which causes people to postpone purchases until prices fall further, and so on. This phenomenon is known as the deflationary spiral – and it almost happened during the global recession of 2008. In such situations, a responsible Central Bank can step in to cut off these destructive feedback loops. So how exactly are Central banks coping with this task?

Imagine that prices in the state economy are at some level, for example, the average cost of a predetermined “basket of goods” is $100. The quantity theory of money states that if you double the amount of money that everyone had in their bank accounts, the same basket of goods will end up being worth $200. Why is that? Although the nominal amount of money has doubled for everyone, the true value of goods has remained the same. This means that people must be willing to part with twice as much nominal money to get the same amount of value. The same principle applies in the opposite direction: if we take half of people’s savings out of the economy, the same basket of goods will end up costing just $50.

Memperluas konsep ini, kami akan mempertimbangkan kasus ketika bank sentral mencoba menenangkan inflasi. Harga tinggi, yang terus meningkat, berarti orang terlalu rela mengeluarkan uang. Yang bisa kita lakukan adalah membatasi jumlah uang yang dimiliki orang untuk mengembalikan harga. (Kami tidak memikirkan bagaimana ini dapat dilakukan untuk saat ini) Demikian pula, kebalikannya berlaku untuk deflasi, yang membuat orang tidak mau mengeluarkan uang. Untuk mengembalikan harga, kami dapat memberi orang lebih banyak uang. Ide sederhana namun penting inilah yang dilakukan bank sentral untuk menstabilkan harga. Terlepas dari kenyataan bahwa alat yang digunakan oleh bank sentral untuk menerapkan kebijakan moneter bisa rumit dan sulit dipahami, misalnya, operasi pasar terbuka dan persyaratan cadangan, bank sentral melakukan dua hal:

- Meningkatkan jumlah uang beredar. Jika bank sentral mendeteksi bahwa harga turun, itu dapat meningkatkan pasokan uang untuk membawa harga kembali ke level sebelumnya.

- Mengurangi jumlah uang beredar. Jika bank sentral mendeteksi kenaikan harga, itu dapat mengurangi pasokan uang untuk mengembalikan harga ke level sebelumnya.

Meningkatkan dan mengurangi jumlah uang beredar bekerja karena teori kuantitas uang menyatakan bahwa harga jangka panjang dalam perekonomian sebanding dengan total pasokan uang yang beredar. Berikut ini adalah contoh teori yang digunakan untuk mempertahankan tingkat harga yang stabil dalam mata uang seperti CENTUS:

Katakanlah Anda ingin menghubungkan mata uang seperti CENTUS ke dolar sehingga satu token selalu diperdagangkan seharga 0,01 dolar AS. Kami akan menunjukkan bahwa Anda dapat melakukan ini dengan meningkatkan atau mengurangi pasokan token Anda tergantung pada seberapa jauh nilai tukar saat ini dari pasak yang diinginkan.

Pertama, kami memperkenalkan konsep permintaan agregat. Secara konseptual, permintaan agregat menggambarkan berapa banyak orang yang secara kolektif menginginkan koin:

demand = (harga koin) * (jumlah koin yang beredar)

Ini juga dikenal sebagai kapitalisasi pasar koin, karena kapitalisasi pasar secara setara menggambarkan berapa banyak orang yang secara kolektif menerima koin.

Biarkan X mewakili jumlah koin yang beredar, yaitu pasokan koin. Mari kita asumsikan bahwa permintaan telah meningkat selama beberapa bulan terakhir, sehingga koin sekarang diperdagangkan seharga $1,10:

permintaan = $1,10 * X

Untuk menentukan bagaimana pasokan koin dapat disesuaikan untuk mengembalikan pasak $1, mari kita asumsikan bahwa permintaan tetap konstan, dan biarkan Y mewakili jumlah koin yang diinginkan yang beredar:

permintaan sebelum = $1,10 * X

permintaan setelah = $1,00 * Y

permintaan sebelum = permintaan setelah

Solusi untuk Y menyiratkan bahwa untuk memperdagangkan satu CENTUS seharga 0,01 dolar AS, Anda perlu meningkatkan penawaran koin Anda sebesar 1,1 kali lipat:

Y = X * 1,1

Sebagai perkiraan kasar, teori kuantitas uang menemukan bahwa jika CENTUS diperdagangkan pada beberapa harga P yang terlalu tinggi atau terlalu rendah, protokol dapat mengembalikan harga jangka panjang menjadi $1 dengan mengalikan pasokan yang ada dengan P. Ada beberapa detail teknis, nanti kita akan berbicara tentang seberapa cepat protokol harus bereaksi, seberapa cepat harga akan bereaksi, dll., Tetapi ide utamanya adalah bahwa untuk mempertahankan pasak dalam jangka panjang, kita hanya perlu mengukur harga CENTUS dan menyesuaikan pasokan token yang sesuai.

We have found out that CENTUS will maintain its peg in the long term if the token supply is adjusted when the token price has changed. How does the CENTUS pro- tocol measure the price of a token? How does this regulate the offer?

Di sini kami menangani masalah ini dengan menyediakan spesifikasi protokol CENTUS lengkap. Untuk pemahaman yang lebih baik, kita dapat mengasumsikan bahwa protokol memiliki semua sifat teknis dari cryptocurrency tradisional, seperti bitcoin (BTC), dan fitur tambahan berikut:

• The protocol defines the target asset for stabilization. This is a US cent for CENTUS. Then the protocol determines the CENTUS target rate to the target asset – 0.01 US Dollar for one CENTUS.

• The smart contract monitors exchange rates to measure the price. The smart contract receives the CENTUS-USD exchange rate source via the Oracle system. This can be done in a decentralized way, as we will describe later.

• The smart contract increases or reduces the supply of CENTUS tokens in re- sponse to deviations of an exchange rate from the peg.

• Smart contract distributes seigniorage to all existing CENTUS owners dur- ing periods of increased supply.

” If CENTUS trades for more than $ 0.01, the smart contract creates and dis- tributes new CENTUS via seigniorage. These CENTUS are determined by the pro- tocol set priority for owners of BILLEX tokens and DBC tokens.

” If CENTUS trades for less than $ 0.01, the smart contract creates and sells BILLEX tokens at an open auction to withdraw the coins from circulation. BILLEX tokens are worth less than one CENTUS, and they can be redeemed for exactly one CENTUS when the Stable Cents are created to increase the offer. This encourages CENTUS owners to participate in the sale of BILLEX and thereby re- duce the CENTUS supply in exchange for the potential payment of BILLEX to- kens in the future.

First, we will explain how the CENTUS protocol gets the CENTUS-USD ex- change rate. Since this information is external to the smart contract, the CENTUS protocol must implement so-called Oracle system, that is, a system that uploads external information to the blockchain. This can be implemented in several ways:

Secure channel. The simplest approach involves using a single channel that loads the real exchange rate into the blockchain, say from Coinbase, Krak- en, or another major exchange. It is obvious that this is the point of central- ization, but it is the simplest and most convenient option.

Delegated decentralized channel. The semi-decentralized approach is to select a small group of channel loaders by CENTUS owners voting. Using this set of channel loaders, the system can select the average exchange rate from them at fixed intervals. If it is discovered that an unscrupulous player is constantly trying to discredit the channel, he will be excluded from the system by coin owners who have an incentive to preserve the long-term value of the system. This reflects most of the advantages of decentraliza- tion. A similar scheme called Delegated proof of stake (DPoS) is even used in other protocols to generate entire blocks.

Decentralized scheme of Shelling points. A fully decentralized approach is to use the Shelling points scheme to determine the exchange rate. The scheme of Shelling points works like this:

- Anyone on the network can vote for what, as he/she think, was the average ex- change rate for the last 5 minutes.

- Suara dikumpulkan setiap 5 menit dan ditimbang sesuai dengan jumlah koin yang dimiliki setiap pemilih. Dengan kata lain, semakin banyak koin yang Anda miliki, semakin banyak bobot suara Anda.

- The weighted median value is taken as the true exchange rate. In addition, weighted 25th and 75th percentiles of price estimates are calculated.” People who guess from 25 to 75 percentiles are rewarded with a set number of newly created CENTUS. This award encourages people to vote, and even more so – to vote with consensus.

- At the request of the community, people who fall outside the 25th or 75th per- centile can be fined by reducing their number of votes.

Due to the fact that the calculation is based on the median, taking into account the number of coins in the voting pool, and a consensus-based reward mechanism is used, the scheme in a substantial way protects itself from unscrupulous participants if none of them owns more than 50% of the voting base of coins. Rules for rewards and punishments need to be developed to encourage enough people to vote. If these incentives are designed correctly, the result provides the same level of securi- ty as Bitcoin (which is also vulnerable if a single miner requires more than 50% CPU mining), Ethereum (if it implements proof of participation), and so on.

Saluran aman dan pendekatan saluran terdesentralisasi yang didelegasikan adalah cara sederhana untuk memuat protokol dengan aman, yang mewakili kompromi antara desentralisasi lengkap dan kemudahan penggunaan. Skema poin Schelling lebih baru, tetapi kami percaya bahwa kami akan dapat membuatnya dapat diandalkan dengan mengembangkan insentif yang tepat. Bagaimanapun, semua implementasi ini adalah alternatif yang valid untuk mengunggah harga CENTUS USD ke protokol CENTUS.

Saat ini, CENTUS memuat nilai tukar nyata ke dalam blockchain menggunakan pertukaran Coinbase, Kraken, dan Binance. Dimungkinkan untuk mempertimbangkan skema desentralisasi titik Shelling di masa depan, ketika memperluas jaringan.

Meningkatkan pasokan bekerja seperti yang dijelaskan di bawah ini.

Opsi dasar untuk meningkatkan pasokan diimplementasikan melalui penjualan CENTUS yang berkelanjutan dan akrual seigniorage kepada pemilik token 2 kali seminggu pada hari Selasa dan Jumat. Suku bunga ditentukan berdasarkan hasil voting pemilik DBC.

Mari kita pertimbangkan opsi untuk meningkatkan pasokan melalui BILLEX.

Pertama, kontrak pintar menghitung semua token BILLEX yang beredar dan memesannya berdasarkan waktu pembuatan, dimulai dengan yang tertua. Urutan obligasi yang dipesan ini disebut Antrian BILLEX.

Then the smart contract counts all issued CENTUS tokens, creates N new CEN- TUS tokens and distributes them as follows:

- BILLEX owners are paid first in order of priority (FIFO-first in, first out). If there are unpaid BILLEX tokens, the smart contract starts converting BILLEX to CENTUS tokens, one to one, according to their place in the BILLEX Queue. For example, if we need to create 100 CENTUS, we convert the 100 oldest out- standing BILLEX into 100 new CENTUS tokens. The FIFO queue encourages people to buy BILLEX sooner rather than later, since BILLEX purchased earlier is paid out before BILLEX purchased later.

Setelah melunasi semua BILLEX, sistem mulai mendistribusikan seigniorage lagi ke semua pemilik CENTUS secara otomatis.- Seigniorage are accrued to DBC owners after BILLEX repayment and after distributing payments to all CENTUS owners. In this case, the system dis- tributes seigniorage (the remaining new coins) proportionally to the DBC owners. For example, if we need to create 1 million CENTUS and there are 0 issued (out- standing) BILLEX and 1 million DBC in circulation, then DBC owners will re- ceive between 10% and 50% of coins depending on CENTUS capitalization. The remaining coins are distributed among CENTUS owners.

To prevent situations in which new BILLEX at the end of the BILLEX Queue will not have value for speculators due to excessive queue length, we have provided a limit on the validity of the BILLEX. The more the BILLEX Queue grows, the longer it will take to pay for new BILLEX at the end of the queue. This leads to a lower price for the new BILLEX, as speculators begin to demand higher returns for the extra time and risk they take. But if the price of new BILLEX drops to zero, the system can no longer reduce the offer – zero price means that no one wants to ex- change their CENTUS tokens for BILLEX tokens. To prevent this from happening, we forcibly terminate all BILLEX that have been in the BILLEX queue for more than 1 year, even if they have not yet been redeemed. We chose the validity period of BILLEX 1 year after the simulation showed that this has led to the creation of a reliable system with high prices for BILLEX even in conditions of very large price fluctuations. However, we reserve the details for further discussion of expiration dates up to 5 years in individual cases.

The mechanism for increasing the supply will be easier to understand in the fol- lowing example:

Katakanlah ada 500 tagihan BILLEX dalam Antrian BILLEX, 200 di antaranya dibuat lebih dari 1 tahun yang lalu.

Mari kita sarankan sistem perlu membuat 1000 koin CENTUS baru.

The system removes the 200 oldest BILLEX from circulation, leaving 300 BILLEX in the queue. If the system needed to create less than 300 coins, it would only buy back the oldest BILLEX. However, the system must create 1000 coins, so it buys back all 300 BILLEX.

The system needs to create another 700 CENTUS coins. The system distributes these 700 coins evenly to existing owners of 1000 CENTUS and 1000 DBC. Each CENTUS and DBC gets 700/1000 = 0.7 / 2=3.5 coins. For example, if you have 100 CENTUS or 100 DBC, you will get 35 coins in the process of increasing the offer and then sell them for USD. (Subject to CENTUS capitalization at $10 mil- lion)

Pengurangan pasokan works as follows. To destroy CENTUS, we must have an effec- tive mechanism that will encourage CENTUS owners not to use their CENTUS in exchange for future payments. We do this by creating a smart contract for BILLEX tokens and then selling them to CENTUS owners. As discussed earlier, BILLEX tokens are sold at an open auction at prices usually less than 1 CENTUS. In return, they promise a future payment of one CENTUS during periods of in- creased supply if the old BILLEX is not in circulation, if the BILLEX has not ex- pired and the BILLEX has not been redeemed within 1 year.

First, we will discuss the open bidding system. To sell BILLEX, the smart contract launches a continuous auction where bidders specify the bid and number of new BILLEX tokens. In other words, auction participants indicate how much they want to pay for each BILLEX and how many BILLEX tokens they want to buy at that price. For example, you can specify that they would like to buy 100 BILLEX at 0.9 CENTUS for one BILLEX. When the system decides to reduce the coin sup- ply, it selects orders with the highest bids and converts the owners’ coins to BILLEX until enough CENTUS are destroyed. As an example:

Mari kita sarankan sistem ingin menjual 100 BILLEX.

Mari kita asumsikan bahwa ada tiga pesanan pembelian dalam tumpukan penawaran: satu tawaran untuk 80 BILLEX masing-masing pada 0,8 CENTUS, satu tawaran untuk 80 BILLEX masing-masing pada 0,6 CENTUS, dan satu tawaran untuk 80 BILLEX masing-masing pada 0,4 CENTUS.

The system calculates the clearing (settlement) price, which is the single price at which all offered BILLEX would be purchased. In this case, the clearing price will be 0.6 CENTUS.

The system executes winning bids at the clearing price: the first user will receive 80 BILLEX in exchange for 80 * 0.6 = 48 CENTUS, and the second user will re- ceive 20 BILLEX in exchange for 20 * 0.6 = 12 CENTUS.

Protokol ini menempatkan batas buatan pada harga token BILLEX untuk memastikan bahwa ia tidak akan mengorbankan masa depan terlalu banyak untuk menandatangani kontrak untuk mengeluarkan koin di masa sekarang. Saat ini kami menetapkan level ini pada 0,10 CENTUS per BILLEX. Kami memodelkan harga BILLEX untuk menunjukkan bahwa bahkan dengan berbagai model permintaan yang sangat luas untuk CENTUS, level ini hampir tidak pernah tercapai.

PENTING: CENTUS issued on the Stellar blockchain are debited automati- cally from the addresses (accounts) of token holders using the Stellar Clawback function in case the rate deviates from the peg by more than 20%, followed by the accrual of BILLEX tokens in equal amounts.

Since the cost of producing paper money is low, the nominal value of a currency can be much higher than the cost of producing it. For example, it costs from 7 to 20 cents to print a US Federal reserve note depending on its face value. Conse- quently, the paper money printer makes a profit by creating more money. The value of money in comparison with its cost price is called seigniorage.

Seigniorage adalah alat terbaik untuk uang elektronik.

Jumlah seigniorage terbesar dikaitkan dengan penciptaan uang elektronik, karena hampir semua jumlah uang dapat dibuat menggunakan elektronik hampir secara gratis.

Similarly, CENTUS owners are entitled to receive an unconditional basic income from the seigniorage, which is a remuneration distributed among CENTUS own- ers.

We described earlier that the seigniorage is distributed twice a week – on Tuesdays and Fridays. The interest rate is determined by voting among participants – owners of CENTUS and DBC tokens.

According to the results of voting among participants on October 04, 2019, a deci- sion was made and recorded in the Telegram channel (https://t.me/coinger_im) to calculate votes based on two parameters:

- Median tingkat persen seigniorage

- Mayoritas suara DBC

Nilai dihitung berdasarkan nilai rata-rata dari kedua indikator.

At the same time, a mandatory condition for DBC token owners voting is the pres- ence of 100 DBC tokens or more on their wallet. This parameter can be changed up or down by DBC token owners’ decision.

More detailed calculation of the seigniorage percent rate Median value can be found in the description of the voting procedure: CENTUS Blog

Sebagai hasil dari pemantauan pemungutan suara untuk tingkat seigniorage di antara pemilik DBC yang diadakan pada 09.09.2019 dan analisis yang dilakukan, diputuskan untuk menambahkan yang berikut ini ke algoritma saat ini untuk menghitung tingkat seigniorage:

- Sertakan kriteria kepemilikan aset DBC dalam perhitungan, dengan mempertimbangkan 1 COIN = 1 VOTE. Dengan kata lain, semakin banyak koin yang Anda miliki, semakin berat suara Anda bertambah.

- Setelah suara dihitung, berikan BONUS dalam jumlah minimum kepada peserta yang memilih hanya dengan salah satu dari dua aset suara. Selanjutnya, algoritma hadiah transparan harus dikembangkan, mungkin tergantung pada jumlah koin atau berdasarkan prediksi median.

- Calculate the final seigniorage rate based on the rates that fall in the range be- tween the weighted 25th and 75th percentiles, based on the voting results.

- To reward people whose desired rates have fallen in the range from 25 to 75 per- centiles with a given amount of BONUS (perhaps the closer to the median, the higher the reward). The winners will receive an increased BONUS amount. This reward encourages people to vote and do it based on consensus.

- In order to prevent the undervaluation or overvaluation of economically justified seigniorage rates, people whose desired rates fall outside the 25 to 75 percentile range should not be rewarded with BONUS.

Dengan menimbang suara sesuai dengan kepemilikan koin, memilih algoritma berdasarkan perhitungan median, dan termasuk mekanisme hadiah berbasis konsensus, skema ini sebagian besar melindungi dirinya dari peserta yang tidak bermoral, kecuali salah satu dari mereka memiliki lebih dari 50% dari koin pemungutan suara. Algoritma ini dikecualikan dalam prinsip kepemilikan koin DBC – tidak lebih dari 30% untuk satu pemilik.

Implementation

Model moneter CENTUS dirancang untuk mendukung mata uang CENTUS dan memberikan kepercayaan diri, terutama ketika pasar mata uang masih kecil. Fungsi utamanya termasuk cadangan dalam stablecoin USD untuk menjaga likuiditas konstan dan mengurangi volatilitas yang berlebihan.

Kontrak pintar CENTUS selalu menawarkan untuk menjual token CENTUS baru atau membeli kembali dan membakar yang sudah ada. Hal ini memungkinkan pasar untuk menentukan pasokan CENTUS sambil mengurangi volatilitas dengan membatasi harga dalam pasak 0,01 USD.

Pendapatan dari penjualan token CENTUS disimpan dalam cadangan, yang tujuannya adalah untuk memastikan nilai CENTUS selama periode ketika mata uang memperoleh kepercayaan independennya. Dana cadangan adalah apa yang memungkinkan kontrak pintar CENTUS untuk menebus token CENTUS bila diperlukan. Cadangan CENTUS hanya disimpan dalam stablecoin USD.

Ketika lebih banyak token dibeli dari kontrak pintar CENTUS, kontrak mengeluarkan lebih banyak koin; ketika token dijual kembali, mereka ditebus dari cadangan sampai level minimum 50% tercapai, setelah itu lelang BILLEX dimulai.

Ketika volume CENTUS meningkat dengan akrual seigniorage yang konstan, total kapitalisasi CENTUS meningkat, meskipun pada harga nominal, nilai total token melebihi cadangan CENTUS. Akibatnya, cadangan CENTUS tidak mengandung kapitalisasi pasar penuh (cap) CENTUS. Dengan kata lain, rasio cadangan CENTUS kurang dari 100%.

Konsep rasio cadangan kurang dari 100% dalam konteks CENTUS memerlukan klarifikasi lebih lanjut untuk menghindari kesalahpahaman. Misalnya, rasio cadangan sebesar 95% tidak berarti bahwa 95% dari pendapatan penerbitan CENTUS disimpan dalam cadangan, dan 5% sisanya ditarik dari cadangan untuk penggunaan lain. Pendapatan selalu disimpan sepenuhnya di cadangan; the decrease in the reserve ratio is due to the fact that the CENTUS contract awards seigniorage to token owners 2 times a week, increasing the supply of coins in the hands of owners. In other words, it is the CENTUS owners who benefit when our model reduces the reserve ratio – by increasing the number of their tokens.

Similarly, a 95% reserve ratio does not mean that the CENTUS contract will buy back only 95% of CENTUS tokens and become insolvent. Instead, the smart contract, when the reserve level reaches 50%, launches a discount auction of BILLEX and sells them to CENTUS owners in exchange for their tokens with a discount that is converted into profit when the bills are repaid later. Thus, the contract always has the ability to redeem any number of CENTUS tokens.

The CENTUS monetary model is primarily based on algorithms. All CENTUS project tokens are issued and circulated on the Stellar blockchain.

This transparently guarantees users that what they have been promised will actually be fulfilled. In the CENTUS model, our mechanism for providing liquidity, which allows participants to determine the CENTUS offer, is considered quite important, so it is implemented using the blockchain. We use a fully decentralized approach, so participants do not need to trust anyone to be sure that the code-based elements of our model are implemented exactly as described.

Not all components of the CENTUS model are based on computer code. Parts of CENTUS activities include interacting with the blockchain, such as managing reserves and awarding partner bonuses.

However, even when the implementation takes place outside of the blockchain, we strive to emulate the transparency of the blockchain as much as possible, informing CENTUS owners about such aspects.

In an ever-changing world, the CENTUS currency cannot rely on a static model. Code-based elements of our model may sometimes need to be modified. Other changes, such as working with new regulatory requirements, cannot be implement- ed through software algorithms. To keep up with the times successfully, the CEN- TUS currency must have a system for making decisions. It is also possible that we will use two blockchains, Stellar and Ethereum, in the work on smart contracts.

When the seigniorage is distributed among CENTUS owners, the number of tokens increases. As a result, the CENTUS reserve – the total net income from the sale of CENTUS tokens – contains less money than the market capitalization of CENTUS – the value of all CENTUS tokens in circulation.

The reserve ratio is defined as the percentage of the market value of CENTUS backed by CENTUS reserves. It reflects the level of market confidence in the CENTUS currency, regardless of the reserve.

For example, when people buy CENTUS knowing that the CENTUS reserve contains only 80% of the CENTUS market value, this is because they believe that CENTUS also has its own intrinsic value; otherwise, they sell CENTUS back to the CENTUS smart contract. Confidence in the independent value of CENTUS should be even higher if CENTUS are traded in the market when the reserve ratio is lower – say, 50%. In this case, the inherent value of CENTUS – its usefulness as a currency, its authority and recognition – is half its total value.

The reserve ratio also reflects the extent to which a CENTUS smart contract can affect the CENTUS price. When the reserve ratio is high, the CENTUS liquidity function has a great ability to mitigate price fluctuations. When the reserve ratio is lower, the CENTUS value is more determined and therefore depends on market confidence; the reserve plays a smaller role in stabilizing price movements.

The CENTUS reserve always remains solvent, even if the reserve ratio is less than 100%. When someone sells a CENTUS token back into a smart contract, the money that was put in reserve when the last token was issued goes to the seller.

The CENTUS monetary model is based on a variable reserve balance. It remains equal to 100% for the first 100 million tokens. At this stage, CENTUS is fully backed up. The CENTUS value is fixed and does not take into account changes in market confidence. Then, when more CENTUS are issued, the reserve ratio gradu- ally decreases, taking into account the increased confidence of the CENTUS market. The reserve ratio is slowly falling to a minimum of 10% when CENTUS market capitalization reaches US $ 1 billion.

Finally, after CENTUS capitalization reaches significant figures, it will no longer make sense to focus on the reserve in assessing the CENTUS value. The new stable system, which adjusts itself as necessary, will support the existence of CEN- TUS as an independent currency.

In this regard, our model simulates the evolution of other currencies: from fully backed by tangible assets (for example, the gold standard); to fractional reserves; based solely on the standard of its governing body.

The CENTUS reserve is stored only in USD stable coins, it shall not be invested anywhere, and serves only for the purchase of CENTUS via a smart contract or on the Stellar market (DEX). If the reserve account receives income from the demand/supply spread, this income used to support CENTUS shall be deposited in the CENTUS reserve.

Further development of CENTUS

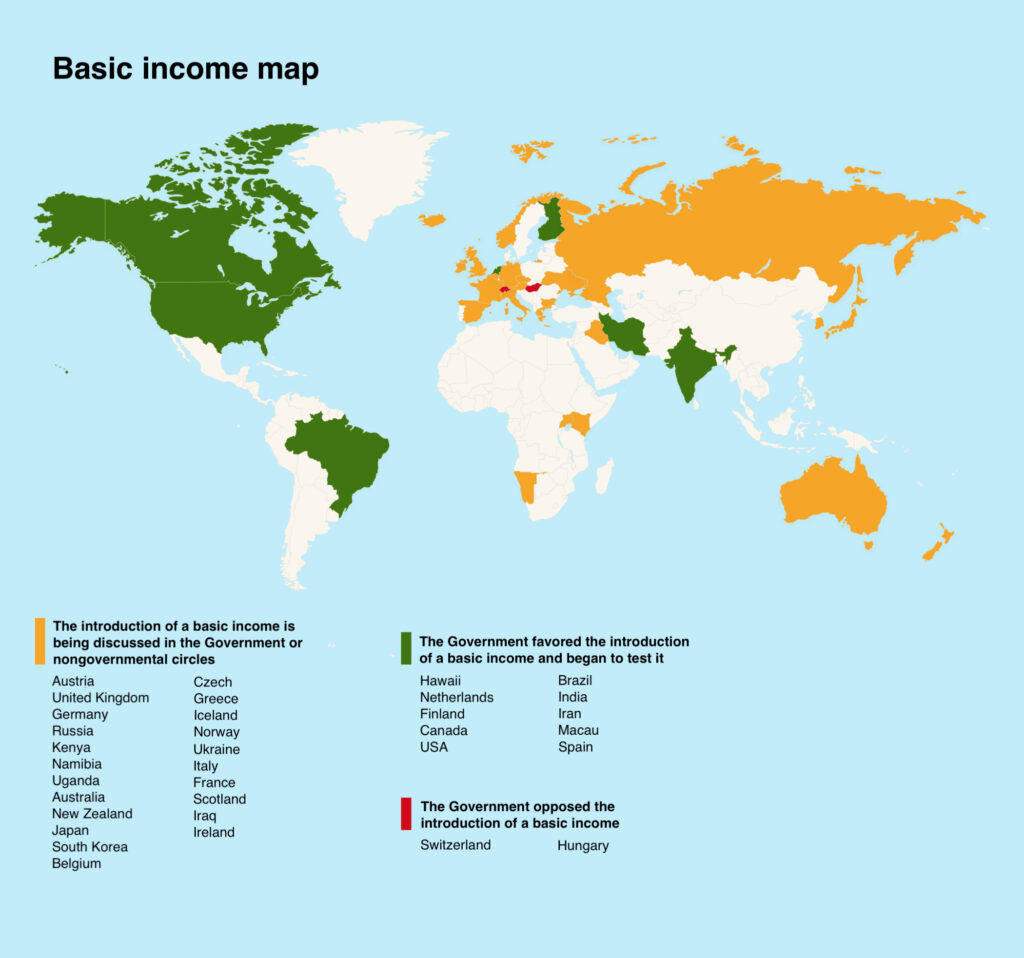

Universal basic income (UBI) is a state or other institutional material support for community members. Universal (guaranteed) income consists in the absence of additional (along with belonging to the society) requirements for receiving assistance. It is believed that such a support system can reduce financial anxiety and improve mental and physical health, increase motivation to work. Typical arguments against a decrease in the desire to work and a corresponding decrease in productivity.

This is a social concept that involves regular payments of a certain amount of money to each member of the community by the state or other institution (such institution is represented by CENTUS seigniorage network in this document).

Universal basic (unconditional) income is regular payments, which are sufficient to cover basic expenses: rent, food, and clothing. They are provided regularly, free of charge, without any counter obligations, and do not depend on age, marital status or income level.

Initially, this method of interaction between the state and the individual was considered from the point of view of eliminating excessive social inequality. This was a key goal. And as an economic background, they used such a concept as “social dividends”. It was introduced by Clifford Douglas, British major, who was convinced that every citizen is entitled to a part of the national wealth.

Everything looks quite logical: if you are a citizen of the country, then you also own part of the national wealth. It is like being a shareowner and receiving a part of the company’s profit in the form of dividends.

Attempts to introduce cyclical payments of UBI in different countries are accompanied by discussions and contradictions of opponents and supporters of this measure of socio-economic support of the population.

Taking into account different approaches, states are trying to replace social payments with monthly accruals of UBI, thereby giving to the society the right to dispose its income based on its needs. However, it was calculated that, if Switzerland had introduced such kind of social benefits, the expenditure for the introduction of this measure would have been about 200 billion dollars per year. Given the financial condition and small population of this country, this figure is significant even for them.

So far, the main sources for payments of universal income have been named as follows:

- Universal basic income should replace all existing social benefits.

- Higher taxes. This is nothing new, and now all social programs are implemented by the state at the expense of taxes. Nevertheless, at present, social benefits and taxes are not symmetrical, that is, taxes are paid by some people, and benefits are received by others. The progressive tax rate is designed to redistribute money from the richest to the poorest.

We can often hear reproaches such as why those who work should support those who do not work, or who, in the opinion of society, do not work enough. What can we reply? It is in the interests of society as a whole. At least, this is how economists and sociologists explain this fact.

In addition, the redistribution of funds between social strata by other means is becoming more difficult.- Another source of payment of universal basic income are funds saved on reducing the bureaucracy. After all, officials dealing with social payments will no longer be needed. Every citizen will simply receive the amount due to him or her on a monthly basis.

- One of the options for obtaining funds for the payment of universal basic income is seigniorage (income received from the issue of money and assigned by the issuer on the property rights).

A number of countries have successfully implemented UBI accrual policy.

Canada

One of the very first experiments on the payment of a universal basic income took place back in the 70s in the city of Dauphin (Canada). The project is called Mincome. According to the project, each resident of the city received monthly payments for 5 years. We must admit that this was one of the longest experiments organized at the state expense.

Evelyn Forget, an economist at the University of Manitoba, studied the results of this experiment. She noted in her report that the level of employment has not decreased at all. At the same time, the number of volunteers has increased, and the social activity of the population has increased.

The rate of hospitalization in the city decreased by 8.5%. During the experiment, a larger number of teenagers graduated from schools, rather than leaving school study unfinished.

Namibia

A coalition of organizations launched a pilot project in Ochivero village, Namibia, with a population of about 1,000 people. For a year, each resident of the village had received 100 Namibian dollars per month. As a result, men stopped illegal hunting, children were not starving, and many children improved their school performance. Employment increased by 11% as people opened pastry shops, hair-dressing salons and brick-making workshops. Additionally, crime rates dropped by 42%.

India

Pada tahun 2011, Asosiasi Pengusaha Wanita, yang didukung oleh UNICEF, melakukan eksperimen yang berlangsung selama satu setengah tahun. Setiap orang dewasa di 10 desa dibayar 200 rupee dan seorang anak dibayar 100 rupee setiap bulan. Kegiatan ekonomi meningkat, makanan dan kehadiran di sekolah meningkat. Pemerintah India memperhitungkan hasil percobaan, mengganti 29 program sosial yang berbeda dengan pembayaran langsung kepada warga.

In addition, this year, Arvind Subramanian, an economic adviser to the government of India, suggested that the introduction of unconditional income at the national level should be considered. In the annual report for the government, the estimated amount was also named – 7620 rupees or $113 per year. Even such a small amount, according to many, could significantly reduce the level of poverty in the country.

Germany

In 2014, the German entrepreneur Michael Bohmeyer started implementation of the pilot programme “Mein Grundeinkommen” (my basic income). Several dozen randomly selected people had been receiving 1,000 euros each month for a year.

All participants of the project note that their sleep has become much calmer. However, not much has changed in their lives in general as students continued to study, workers continued to work.

The author of the project noted that the idea of basic payments is based on four principles: it is universal, it solves individual problems, it does not depend on any conditions and creates a high minimum standard of living for citizens.

Many countries are in the middle of an “experiment” now. We will be able to evaluate the results only after some time. You can find few examples of these countries below.

Finland

The Finnish national insurance authority has proposed replacing social benefits with a fixed payment for all adult citizens of the country, regardless of income level. It is expected to set payments at 550 euros per month, and later raise to 800 euros.

Kenya

In October 2016, Givedirect, the New York based charity organization which fights poverty in East Africa, launched the largest project thus far for paying an universal basic income in Kenya. Residents of 40 villages will receive about $ 22.5 per month for 12 years. This is not just a charity event, but a scientific experiment aimed at collecting and analysing data on the effectiveness of universal basic income.

USA

Participants of the Economic Security Project, launched at the end of 2016, are researching the potential benefits of universal basic income in developed economies. The initiators of the project with a budget of 10 million dollars are more than 100 organizations and individuals, including Chris Hughes, Facebook cofounder, and Sam Altman, Y Combinator Foundation President.

Spain

As part of measures to mitigate the social and economic consequences of the coronavirus pandemic, the Spanish government is going to introduce a universal basic income in the near future. Nadia Calvino, Minister of Economic Affairs, announced this on April 5, 2020. The Spanish government wants to maintain a universal basic income even after the epidemic. The Minister of Economic Affairs expressed hope that the universal basic income will remain a “permanent structural tool”.

There are about 20 ongoing experiments in the world related to the payment of universal income. Scientists are trying to figure out whether we are motivated enough to continue working without starving.

Any member of the CENTUS seigniorage network, a coin owner, is entitled to receive basic income in the form of interest accrued on the amount of coins in his wallet. The basic income rate is determined by network participants – owners of DBC tokens intended for project management. This is done to prevent CENTUS coin owners from indefinitely inflating the interest paid, thus no excessive supply of coins is created on the market.

In the CENTUS seigniorage network, not only participants who bought coins can receive basic income. It is also possible for those members of the community who do not have the opportunity to purchase tokens to receive such income. To do this, participants can promote the project at a certain stage by earning and accumulating special bonuses, which they can convert to CENTUS and receive basic income. Of course, they can sell these coins at any convenient moment.

In the future, as the project develops and the capitalization of CENTUS increases, in addition to interest charges, it is planned to add a payment of a minimum fixed amount in absolute terms, for example, from $50-100 to several hundred US dollars, to each CENTUS participant.

At the initial stage, we reserve the right to use any combination of seigniorage (basic income) payments, including dividing accruals depending on how CENTUS was received: for example, those who purchased tokens at their own expense can count on the maximum payout, while those who received them through bonus and other exchanges, as well as various incentive programs can receive accruals par- tially.

People living in developed countries take for granted the availability of a stable currency. If you are in the US with unlimited access to dollars or in the EU with access to euros, you may wonder why the world needs a digital currency with a stable price. However, in countries with weak financial institutions and unstable currencies, high rates of inflation and currency devaluation are common. We expect CENTUS with its stable price and integral seigniorage to be in high demand in these markets.

At the time of publication in the second quarter of 2020, annual inflation in Egypt was 6.8%, in Argentina – 50.3%, and in Nigeria – 12.2%. These are only those countries whose governments are relatively more stable. Let us look at Venezuela, which currently has an annual inflation rate of 9586%. What would you do if your savings were disappearing at a rate of 9586% a year? Faced with a rapidly depreciating local currency, people are looking for other ways to survive, often leaning towards the dollar. This effect is known as dollarization.

It usually takes three forms:

- Pertama, penduduk mungkin lebih suka menggunakan dolar daripada mata uang lokal tanpa koordinasi dari pemerintah daerah. Dolar AS digunakan sebagai mata uang de facto di sejumlah negara di Asia Tengah dan Afrika Sub-Sahara, dan tingkat adopsinya bisa sangat tinggi, meskipun kurangnya koordinasi resmi. Misalnya, selama 2 tahun dari 2006 hingga 2008, dolarisasi di Seychelles melonjak dari 20% menjadi 60%.

- Secondly, citizens of a country can demand the dollar, despite state capital controls that prevent the movement of the dollar across its borders. It is no secret that there was a black dollar market in Argentina, known as dollar blue, during the period of capital control from 2011 to 2015. Over those years, between $ 10 and $ 40 million per day changed hands at rates that were 25-30% higher than the official rate. These bets were even published daily in national newspapers, despite being officially illegal.

- Third, currency devaluation can become so severe that governments can officially switch to US dollars, as happened in Zimbabwe in 2009. Today the entire country requires regular deliveries of physical paper dollars and coins.

The prospects are obvious. Regardless of whether dollarization is officially approved, citizens, banks, and governments incur significant costs when importing physical US dollars. CENTUS, which allows millions of dollars to be transported by making the phone call and generates regular income, seems to be a significantly better alternative to paper dollars in all dollarization scenarios.

In conclusion: existing digital currencies have found an appeal in some countries with hyperinflation, for example, the use of bitcoins in Venezuela is growing as the country has faced a currency crisis. However, Bitcoin can never truly free people from their unstable local currency due to the lack of quote stability. For example, if bitcoin goes through a devaluation cycle, users do not see the difference between devaluing bitcoin and devaluing the local currency. Even if bitcoin only crashes once, people will want to switch to an alternative that is stable in price – if such option exists. Thus, the CENTUS seigniorage stablecent, which allows you to receive regular income, will be an excellent solution for developing countries experiencing rapid currency devaluation.

Saat ini, banyak peserta pedagang pasar kripto mengubah mata uang kripto mereka menjadi koin stabil yang dipatok ke dolar AS ketika ada turbulensi di pasar mata uang kripto. Untuk memenuhi kebutuhan ini, solusi terpusat, yang dikenal sebagai USD Tether, telah dibuat, tetapi untuk alasan yang akan dibahas nanti, solusi terpusat seperti Tether sepertinya tidak akan berhasil dalam jangka panjang, dan akibatnya, Tether menghadapi tantangan yang signifikan. sentimen negatif. Selain itu, ketika pasar jatuh dan pedagang menyimpan asetnya dalam stablecoin biasa, seperti USD Tether, ia tidak mendapatkan keuntungan apa pun, tidak seperti CENTUS, yang juga memiliki harga yang stabil dan pada saat yang sama mendatangkan pendapatan (seigniorage). kepada pemiliknya.

A seigniorage digital currency with a stable price can meet the needs of digital traders. Therefore, cryptocurrency traders can naturally be enthusiastic about the new protocols, and here we expect initial demand for CENTUS Stable Cent.

CENTUS combines a digital currency that brings its owner a profit in the form of a seigniorage at the growth stage, and a stable coin pegged to the US dollar.

Due to instability, today’s cryptocurrencies are not suitable for even the most basic financial contracts that our economy relies on. Can you imagine a job for which you get one bitcoin per month, but you pay all your monthly bills in US dollars – what will happen to you and your family if the price of BTC falls? How about buying a home with a 30-year mortgage denominated in bitcoin, in a world where you probably still get paid in dollars? It is impossible to predict the development of events in such cases, because the credit and debt markets, and in fact the markets for any financial contract over time depend on price stability.

Saat memasuki perjanjian hipotek, risiko terbesar yang Anda ambil sebagai pemberi pinjaman adalah risiko gagal bayar. Namun, jika hipotek ini didenominasi dalam aset yang tidak stabil seperti Bitcoin, Anda juga menghadapi risiko harga yang sangat tinggi. Misalnya, biaya hipotek berdenominasi bitcoin 30 tahun tiba-tiba bisa sangat rendah jika harga Bitcoin turun 90% pada hari tertentu selama 30 tahun ke depan. Untuk membuat kesepakatan, Anda harus siap untuk berspekulasi tentang harga Bitcoin untuk setiap pinjaman yang Anda berikan atau mencari spesialis yang akan melakukan ini. Bagaimanapun, peminjam harus membayar kesediaan Anda untuk melindungi risiko harga. Ini menambahkan aspek, yang sulit dinegosiasikan, pada kontrak keuangan yang paling sederhana.

A number of visionaries in the blockchain industry believe that we will soon see an ecosystem of “blockchain applications” that implement existing services with decentralized tools. For example, one day we may see “Uber blockchain” atau “Airbnb blockchain”, each using its own tokens. In fact, this is already happening with Filecoin, a service for decentralized file storage on the Internet.

Of course, if each blockchain application will create its own token, then there must be a conversion system between “a universal token that during its holding brings a constant income and has 100% liquidity” and the tokens of any of these applications. We assume that each person will become a owner of a universal token and will pay with it when using any blockchain application. Then, after payment, the universal token will be immediately converted into an app token at the market rate. This will be similar to your bank account in US dollars and using your debit card in another country, such as Spain, in which case your bank converts your US dollars to euros at the market rate every time you make a purchase, without having to think about it. At the same time, you also get a regular basic in- come in the form of a seigniorage for tokens.

If there were this ecosystem of blockchain applications that would require the use of a universal token, it would be very strange if this universal token were not stable in price with the condition of regularly received income. In other words, if you believe in the future of blockchain applications, you not only have to believe that a stable price coin will be required for exchange, but also hope that a stable price coin will be successful.

Annex

White Paper – documentation that describes the project, new process, or algorithm in detail. It is part of the company’s content strategy. Its purpose is to provide useful information about solving a particular problem.

Token, digital token – a term used in the cryptocurrency environment to refer to an intangible asset, a tool that gives access to certain services, or an internal currency.

Cryptocurrency – a type of digital currency, creation and control of which are based on cryptographic methods. As a rule, the record system of cryptocurrencies is decentralized. The functioning of these systems is based on blockchain technology. Transaction information is usually not encrypted and is available to public. Cryptographic elements are used to ensure that the transaction block chain database is unchanged (digital signature based on a public key system, sequential hashing).

Blockchain – rantai blok berurutan berkelanjutan (daftar terhubung) yang dibangun sesuai dengan aturan tertentu yang berisi informasi (tentang transaksi, perjanjian, dan kontrak). Salinan rantai blok disimpan dan diproses secara independen di banyak komputer yang berbeda. Paling sering, blockchain berisi informasi tentang transaksi di berbagai cryptocurrency, tetapi blok juga dapat berisi informasi lain.

Decentralization – proses mendistribusikan fungsi di seluruh sistem tanpa satu pusat pun. Jaringan terdesentralisasi (peer-to-peer network) adalah jaringan komputer berdasarkan kesetaraan peserta. Seringkali tidak ada server khusus dalam jaringan seperti itu, dan setiap node (peer) adalah klien dan dalam waktu yang sama berfungsi sebagai server. Organisasi ini memungkinkan Anda untuk mempertahankan kinerja jaringan dengan jumlah berapa pun dan kombinasi node yang tersedia.

Kontrak pintar - kode program yang menjelaskan serangkaian kondisi yang menyebabkan peristiwa tertentu dalam sistem komputasi terjadi. Ini dirancang untuk implementasi teknis kesimpulan dan pemeliharaan kontrak komersial dalam teknologi blockchain.

bintang – jaringan open source untuk mata uang dan pembayaran. Perangkat lunak ini beroperasi dalam jaringan terbuka yang terdesentralisasi dan memproses jutaan transaksi setiap hari. Stellar mengandalkan blockchain untuk sinkronisasi jaringan.

Alamat bintang – satu set karakter unik untuk mengirim / menerima cryptocurrency. Alamat tidak diulang dalam jaringan. Alamat juga bertindak sebagai kunci publik yang digunakan untuk menandatangani blok.

Fiat money – uang biasa, nilai nominal yang ditetapkan dan dijamin oleh negara (dolar, euro, rubel).

The purpose of this White Paper is to provide information about the CENTUS project to potential buyers of CENTUS stable cent, DBC token, BILLEX token on the basis of which it will be possible to make a purchase decision. The information provided in this document is not exhaustive and does not imply any contractual obligations and can only be considered as marketing information about the project. The project information in this document is subject to change, update without prior notice and cannot be considered as a form of obligations of CENTUS, as well as related legal entities that support the project. CENTUS reserves the right to change the text of this document without any prior notice and at any convenient time.

Tidak ada dalam dokumen ini yang dapat ditafsirkan sebagai penawaran investasi dalam bentuk apa pun. Penawaran ini bukanlah penawaran untuk menjual atau membeli sekuritas di yurisdiksi mana pun. Dokumen ini tidak menawarkan untuk membeli token kepada individu dan perusahaan yang tidak memiliki kapasitas hukum yang cukup untuk berpartisipasi dalam pertukaran moneter.

Jika Anda tidak yakin bahwa Anda memenuhi syarat untuk berpartisipasi dalam proyek CENTUS, Anda harus menghubungi konsultan hukum, keuangan, pajak, atau konsultan profesional lainnya. Partisipasi dalam proyek CENTUS bersifat sukarela.

Apa yang menginspirasi kami untuk menciptakan CENTUS Stable Cent?

Basis adalah proyek yang juga memperkenalkan gagasan untuk meningkatkan dan mengurangi pasokan koin untuk mempertahankan tingkat suku bunga. Basis diluncurkan pada 2017 dan ditutup pada akhir 2018, dengan penggalangan dana $ 133 juta, daftar penasihat yang mengesankan, dan tim yang kuat. Alasannya adalah bahwa di bawah hukum AS, token mereka dianggap sebagai sekuritas dan tunduk pada pembatasan sekuritas.

Kami menyukai banyak hal tentang proyek Basis, dan dokumen ini sangat bergantung pada Buku Putih mereka. Kami memutuskan untuk mengambil yang terbaik darinya tetapi memperbaiki skema dengan menambahkan pembayaran seigniorage ke semua pemilik token CENTUS, serta cadangan sebagian untuk kontrak pintar, yang bertindak sebagai pembuat pasar untuk peserta, menjual dan membeli CENTUS dengan menggunakan cadangan.

Kami memperhitungkan masalah hukum Basis dan menawarkan tagihan pertukaran BILLEX alih-alih obligasi, yang dibuat sendiri oleh para peserta melalui kontrak cerdas dengan imbalan CENTUS. Dalam hal ini, masalah legislatif selesai sepenuhnya, karena setiap orang atau badan hukum dapat menerbitkan tagihan tanpa harus memiliki lisensi, karena masalah tagihan diatur oleh Law of Great Britain on Bills (1882), yang secara jelas mengatur prosedur penerbitan dan peredarannya. Protokol CENTUS hanya menawarkan kepada peserta platform yang nyaman untuk menerbitkan tagihan pertukaran diskon BILLEX di bawah CENTUS mereka. Selain itu, sistem CENTUS dengan reservasi parsialnya akan memungkinkan peningkatan pasokan tanpa keamanan wajib 100%, yang akan memungkinkan lebih banyak fleksibilitas dalam kebijakan peningkatan pasokan, terutama pada tahap pertama pengembangan.

Bayangkan sebuah dunia di mana Bitcoin mulai bersaing dengan dolar AS untuk penggunaan transaksi. Anda dibayar dalam bitcoin, tetapi Anda membayar sewa dalam dolar, atau mungkin sebaliknya. Ini tidak masuk akal, mengingat volatilitas yang melekat pada Bitcoin.

This article has presented CENTUS — a reliable, decentralized implementation of digital currency with a stable price and regular seigniorage for coin owners. We believe that if we can just make sure that the purchasing power of the currency does not change, people will give up the idea that it is not worth having a lot of digital currencies, and come to the understanding that storing their savings or incomes in CENTUS Stable Cent is reliable and profitable. We believe that this feature will help our tokens pass the acceptance cycle and help them move to the main exchange environment – a result that no other digital currencies has yet managed to achieve.

Jika Anda memiliki pemikiran atau ingin berpartisipasi dalam proyek ini, jangan ragu untuk menulis kepada penulis yang tercantum di halaman judul. Untuk versi terbaru dari dokumen ini, kunjungi situs web http://www.centus.one