CENTUS White Paper

Introduction

Many digital currencies have been generated in the modern world and are being used as a quasi-money. Cryptocurrencies often have the same functions as money issued at the level of state regulation, and act as an intermediary tool in commodity exchange.

Just like state-issued money (fiat), digital currencies undergo a full-fledged continuous stage of development along with the endless process of development of society:

– Fast response to scientific and technological progress. All engineering and technological achievements are implemented in the money production process.

– Increase in the speed of money circulation, and, as a result, the speed of payments. In turn, this trend is limited in the growth of the payment acceleration price (the growth of commission for conducting and other costs) and its security (ambition to minimize the risk of losing money during the payment).

– Increased availability of payment tools and controllability of the funds transfer process. Enterprises and buyers strive to use the most affordable and simple payment tools.

However, with all the obvious advantages of using digital currencies in the settlement system, cryptocurrency saving and use in everyday life, they have not received mass application both in business and at the consumer level. We believe it is connected to the following issues:

Issue No. 1: Cryptocurrency is difficult to understand

Issue No. 2: Instability and volatility

Issue No. 3: Lack of legal and technical regulation

Issue No. 4: No way to output digital currency to the real world

Private issuers who issue their digital currencies for various purposes carry out informing and training of users on the cryptocurrency market, helping them to understand its nature and ways of using it. The infrastructure required for effective operation is developing at the right pace to solve the problem of cryptocurrency output to the real world. However, in order to make a typical purchase or exchange operation and get the result in the form of real goods or cash, the user needs to use the services of several companies, each of them requires additional time to conduct the transaction and high costs in the form of commissions. At the intersection of two – cryptocurrency economy and classical economy, the problem of developing a single solution has become more urgent than ever.

The price volatility of bitcoin (BTC) and other cryptocurrencies is one of the biggest barriers to the widespread adoption. Unlike paper currencies (fiat), modern digital currencies do not have a Central Bank that implements monetary policy to maintain stable purchasing power, which means that changes in demand can cause massive price fluctuations. If users cannot be sure that the purchasing power of their accounts will remain stable, they will never use cryptocurrency as a medium of exchange instead of alternative assets that have a stable value. Despite the fact that many studies have focused on technical topics such as transaction throughput and smart contracts, compared to them, almost no attention is paid to improving price stability, and we believe that this problem is a much more serious obstacle to the mass adoption of cryptocurrency as mean of exchange.

CENTUS is designed to maintain a stable value, as well as to generate regular basic income (seigniorage) for its owners, and it is a medium of exchange available to anyone connected to the Internet.

CENTUS is a digital currency which token reliability is secured by its peg to the US dollar, while remaining fully decentralized. The CENTUS Protocol algorithmically adjusts the issuance of CENTUS tokens in response to CENTUS exchange rate changes against the USD. This makes it possible to implement monetary policy that is similar to policy of Central banks around the world, except that it uses a decentralized algorithm based on protocols, without the need for direct human intervention.

CENTUS may become a possible solution for the currency volatility issue in using it for loan and salary service, or other major financial contracts.

In addition, the most important difference between CENTUS and other stable coins is that its owners receive a regular basic income (seigniorage), paid on a weekly basis (Tuesday and Friday), directly to the wallets of participants.

CENTUS is designed to keep prices stable by algorithmically adjusting the offer.

CENTUS mission is to create wealth and redistribute it among simple people — Centus Seigniorage network members.

Stable Cent (CENTUS) is an algorithmic stable digital currency on the Stellar blockchain. The number of Stable Cents in circulation increases or decreases according to the specified algorithm, depending on the demand in the market.

100 CENTUS ≈ 1 USD

By enabling participants to buy and sell CENTUS, the smart contract serves as a market maker. To buy CENTUS, participants need to transfer funds to the smart contract address, where they are stored as a variable reserve. The main purpose of the CENTUS reserve is to provide participants with the opportunity to sell their CENTUS tokens at any time; the contract buys CENTUS using funds from the reserve.

Twice a week, the “smart contract” issues new CENTUS and distributes them proportionally among existing CENTUS holders, taking into account the market demand.

As result, CENTUS owners receive an income called “Seigniorage”.

Seigniorage is the state’s revenue from issuing money. Central banks can influence the level of seigniorage that governments receive by regulating the growth rate of the monetary system.

We believe that the distribution of CENTUS among existing CENTUS owners is the main basis for the stability of the system. Moreover, we are sure that this speculative component ensures CENTUS stability.

When the seigniorage is distributed among CENTUS owners, the coin has two sources of value: the CENTUS stable cent itself and the seigniorage that people receive twice a week. CENTUS Stable Cent is pegged to 1 US CENT (¢). Since CENTUS owners regularly receive seigniorage, the cost of CENTUS is equal to 1¢ + seigniorage.

We believe that if market participants expect new payments to CENTUS owners in the near future, they will buy CENTUS for speculative reasons. The CENTUS algorithm will respond to this increased demand by creating new CENTUS to restore the coin price to 1 US CENT.

Although it likely will encourage speculators to buy even more CENTUS to get profit from these new coins and cause long periods of artificial increase and retaining price above 1 cent, algorithm for seigniorage reducing while raising prices on CENTUS will have a beneficial effect on the stabilization of the exchange rate at the level of 1 cent approximately.

It is natural to think that distributing new coins to existing CENTUS owners will only increase the value of CENTUS, as it creates an attractive speculative component that rewards people for accepting CENTUS.

We believe that adding this speculative component will stimulate constant demand, and a floating interest seigniorage will only add to the utility of CENTUS without compromising its stable value.

According to our forecasts, this will significantly increase the real and long-term value of CENTUS for market participants.

CENTUS will not be “printed” for the future — each unit will be created when the user purchases it, and in the case of reverse exchange — destroyed. Thus, assets transferred to the reserve secure the CENTUS stock.

CENTUS token is, first of all, not a token for speculation by exchange traders, but mainly a means of accumulation and income generation by simple people – its owners, as well as a means of settlements between them.

We do not seek external financing from third-party investors, for the reason that in the future they will demand high returns in exchange for early investments, we sincerely believe that these high returns can be directly sent to people who buy CENTUS without these first intermediaries.

The CENTUS Protocol is easier to understand if you compare it with the Federal Reserve (FED). Like the FED, the CENTUS smart contract controls price levels and adjusts the money supply by performing operations on the open market, which in our case consist of creating CENTUS tokens or BILLEX tokens (we tell more about it below). As with the FED, these operations are predicted by quantity money theory to produce long-term price levels at the desired peg.

CENTUS liquidity

The CENTUS currency includes a liquidity mechanism designed to mitigate the impact of market forces when they cause volatility in the value of CENTUS. The CENTUS smart contract offers a permanent sale of new CENTUS tokens at a price close to 0.01 US dollars. And vice versa, the contract offers to buy back and destroy CENTUS tokens at a price close to 0.01 dollars. A smart contract allows a spread within which speculative participants can earn profits by maintaining the coin’s peg.

Thus, the supply of CENTUS tokens is determined by demand: tokens are issued or withdrawn from circulation depending on the market. In addition, the CENTUS value is between the purchase price and the offer price. Within the range defined by the CENTUS smart contract, transactions can be made on secondary markets without involving a smart contract.

Revenue from the issuance of new CENTUS tokens is fully reserved. The reserve is created solely through the sale of CENTUS tokens, and its sole purpose is to give the CENTUS smart contract the ability to redeem tokens, if necessary. The cost of maintaining the reserve is covered by the reserve itself.

About Tokens

These are the main tokens of the system. They are pegged to the US dollar and intended to be used as means of exchange and revenue generation through the distribution of seigniorage among token owners. Their offer increases and decreases in order to maintain a price peg to 0.01 US dollars.

The CENTUS design and development process requires funding. We believe that this process should reflect the values and principles that we want to promote. Since our project declares integrity and low volatility, we did not want to start the development of CENTUS with public speculation through ICO. Accordingly, we decided to use only the founders’ own funds as the first participants of the CENTUS project.

We use a special token called Debit Coin (DBC) to provide compensation to early founding members and other interested parties. DBC is a voucher token that can be converted to CENTUS at will. The amount of CENTUS received during conversion is pre-modelled and depends on the size of the CENTUS economy: the amount starts from zero and increases only if the CENTUS economy achieves real success. This ensures that the interests of DBC owners do not conflict with those of CENTUS owners.

The number of DBC tokens is equal to 100 million. Owners of these tokens have the right to vote on the seigniorage interest rate paid when the offer is increased.

DBC has a built-in restriction on the CENTUS economy impact. The conversion rate of DBC to CENTUS is limited to 1:500, so the cumulative impact of DBC owners is limited. To reduce the influence of any individual entity, the size of shares is also limited to a maximum of 30 percent per one owner.

DBC owners will only be able to receive a seigniorage on this asset in case the capitalization of CENTUS gets at least 10 million. After that, as the system grows and the number of CENTUS in circulation increases, the amount of seigniorage for DBC owners will gradually increase from 10% to 50% of the total amount of accrued seigniorage.

Thus, DBC owners bear the highest risks. This can be compared to holding ordinary shares of a company, whereas CENTUS is more like a preferred stock, with a “guaranteed” seigniorage, but without voting rights and super-dividends.

DBC can always be exchanged for CENTUS at the current exchange rate. The higher the DBC rate, the more CENTUS you can get (the maximum limit is 500 CENTUS). DBC can only be exchanged once, and they are removed from circulation and burned during the exchange.

Discount bills of exchange on the blockchain. These tokens are sold through a blockchain auction when you need to reduce the CENTUS offer. BILLEX is not pegged to anything, and each bill promises that a owner gets exactly one CENTUS at a certain point in the future under certain conditions. Since newly created BILLEX are sold at an open auction for less than one CENTUS, you can expect a competitive bonus or “yield” for buying bills when they are redeemed at par.

Conditions under which BILLEX is redeemed:

- A smart contract creates and distributes CENTUS, which means that it determines necessity to increase the CENTUS supply.

- BILLEX is not expired, i. it was created less than 1 year ago.

- All previous BILLEX tokens created before these BILLEX tokens were redeemed or expired.

Interconnection of tokens for stability assurance

CENTUS provides price stability using the same economic principles that Central banks around the world rely on. The most important of these is the quantity theory of money. In this section, we will cover the following topics:

- How does the quantity theory of money relate a long-term price levels with demand and supply of money?

- How does the CENTUS Protocol assess changes in demand by tracking the exchange rate between CENTUS and its pegged assets?

- How does the CENTUS Protocol increase and decrease the issuance of CENTUS tokens based on the exchange rate?

- Creating markets for increasing and reducing CENTUS supply.

History shows that in times of rising and falling markets, people often make economically significant decisions under the influence of panic and without regard for common sense. During an economic boom, people have more money, so they want to buy more goods, which leads to higher prices for goods, which encourages demand for higher wages, which means that people have even more money. This phenomenon is known as the inflationary spiral, and this is what happened in Germany in the 20s, Brazil in the 80s and Argentina in the 90s. Similarly, in an economic downturn, people are afraid to buy goods, resulting in lower prices for goods, which causes people to postpone purchases until prices fall further, and so on. This phenomenon is known as the deflationary spiral – and it almost happened during the global recession of 2008. In such situations, a responsible Central Bank can step in to cut off these destructive feedback loops. So how exactly are Central banks coping with this task?

Imagine that prices in the state economy are at some level, for example, the average cost of a predetermined “basket of goods” is $100. The quantity theory of money states that if you double the amount of money that everyone had in their bank accounts, the same basket of goods will end up being worth $200. Why is that? Although the nominal amount of money has doubled for everyone, the true value of goods has remained the same. This means that people must be willing to part with twice as much nominal money to get the same amount of value. The same principle applies in the opposite direction: if we take half of people’s savings out of the economy, the same basket of goods will end up costing just $50.

Expanding this concept, we will consider the case when a central bank tries to soothe inflation. High prices, which are constantly rising, mean that people are too willing to spend money. What we can do is to limit the amount of money people have to restore prices. (We do not dwell on how this can be done for now) Similarly, the opposite applies to deflation, which makes people unwilling to spend money. To restore prices, we can give people more money. This simple but important idea is exactly what central banks do to stabilize prices. Apart from the fact that the tools used by central banks to implement monetary policy can be complex and difficult to understand, for example, the open market operations and reserve requirements, a central bank does two things:

- Increasing the money supply. If a central bank detects that prices are falling, it can increase the supply of money to bring prices back to the previous level.

- Reducing the money supply. If a central bank detects prices rising, it can reduce the supply of money to bring prices back to their previous level.

Increasing and decreasing the money supply works because the quantity theory of money states that long-term prices in the economy are proportional to the total supply of money in circulation. The following is an example of the theory used to maintain a stable price level in a currency such as CENTUS:

Let us say you want to link a currency like CENTUS to the dollar so that one token is always traded for 0.01 US dollars. We will show that you can do this by increasing or reducing your token supply depending on how far the current exchange rate is from the desired peg.

First, we introduce the concept of aggregate demand. Conceptually, aggregate demand describes how many people collectively want a coin:

demand = (coin price) * (number of coins in circulation)

This is also known as the market capitalization of a coin, since market capitalization equivalently describes how many people have collectively accepted a coin.

Let X represent the number of coins in circulation, i.e. the supply of coins. Let us assume that demand has increased over the past few months, so the coins are now trading for $1.10:

demand = $1.10 * X

To determine how the supply of coins can be adjusted to restore the $1 peg, let us assume that demand remains constant, and let Y represent the desired number of coins in circulation:

demand before = $1.10 * X

demand after = $1.00 * Y

demand before = demand after

The solution for Y implies that in order to trade one CENTUS for 0.01 US dollars, you need to increase the offer of your coin by 1.1 times:

Y = X * 1.1

As a rough estimate, the quantity theory of money finds that if CENTUS trades at some P price that is too high or too low, the protocol can restore long-term prices to $1 by multiplying the existing supply by P. There are some technical details, later we will talk about how fast the protocol should react, how fast prices will react, etc., but the main idea is that to maintain the peg in the long term, we just need to measure the price of CENTUS and adjust the token supply accordingly.

We have found out that CENTUS will maintain its peg in the long term if the token supply is adjusted when the token price has changed. How does the CENTUS pro- tocol measure the price of a token? How does this regulate the offer?

Here we handle these issues by providing the full CENTUS protocol specification. For a better understanding, we can assume that the protocol has all the technical properties of a traditional cryptocurrency, such as bitcoin (BTC), and the following additional features:

• The protocol defines the target asset for stabilization. This is a US cent for CENTUS. Then the protocol determines the CENTUS target rate to the target asset – 0.01 US Dollar for one CENTUS.

• The smart contract monitors exchange rates to measure the price. The smart contract receives the CENTUS-USD exchange rate source via the Oracle system. This can be done in a decentralized way, as we will describe later.

• The smart contract increases or reduces the supply of CENTUS tokens in re- sponse to deviations of an exchange rate from the peg.

• Smart contract distributes seigniorage to all existing CENTUS owners dur- ing periods of increased supply.

” If CENTUS trades for more than $ 0.01, the smart contract creates and dis- tributes new CENTUS via seigniorage. These CENTUS are determined by the pro- tocol set priority for owners of BILLEX tokens and DBC tokens.

” If CENTUS trades for less than $ 0.01, the smart contract creates and sells BILLEX tokens at an open auction to withdraw the coins from circulation. BILLEX tokens are worth less than one CENTUS, and they can be redeemed for exactly one CENTUS when the Stable Cents are created to increase the offer. This encourages CENTUS owners to participate in the sale of BILLEX and thereby re- duce the CENTUS supply in exchange for the potential payment of BILLEX to- kens in the future.

First, we will explain how the CENTUS protocol gets the CENTUS-USD ex- change rate. Since this information is external to the smart contract, the CENTUS protocol must implement so-called Oracle system, that is, a system that uploads external information to the blockchain. This can be implemented in several ways:

Secure channel. The simplest approach involves using a single channel that loads the real exchange rate into the blockchain, say from Coinbase, Krak- en, or another major exchange. It is obvious that this is the point of central- ization, but it is the simplest and most convenient option.

Delegated decentralized channel. The semi-decentralized approach is to select a small group of channel loaders by CENTUS owners voting. Using this set of channel loaders, the system can select the average exchange rate from them at fixed intervals. If it is discovered that an unscrupulous player is constantly trying to discredit the channel, he will be excluded from the system by coin owners who have an incentive to preserve the long-term value of the system. This reflects most of the advantages of decentraliza- tion. A similar scheme called Delegated proof of stake (DPoS) is even used in other protocols to generate entire blocks.

Decentralized scheme of Shelling points. A fully decentralized approach is to use the Shelling points scheme to determine the exchange rate. The scheme of Shelling points works like this:

- Anyone on the network can vote for what, as he/she think, was the average ex- change rate for the last 5 minutes.

- Votes are aggregated every 5 minutes and weighted according to the number of coins each voter possesses. In other words, the more coins you have, the more weight your vote gets.

- The weighted median value is taken as the true exchange rate. In addition, weighted 25th and 75th percentiles of price estimates are calculated.” People who guess from 25 to 75 percentiles are rewarded with a set number of newly created CENTUS. This award encourages people to vote, and even more so – to vote with consensus.

- At the request of the community, people who fall outside the 25th or 75th per- centile can be fined by reducing their number of votes.

Due to the fact that the calculation is based on the median, taking into account the number of coins in the voting pool, and a consensus-based reward mechanism is used, the scheme in a substantial way protects itself from unscrupulous participants if none of them owns more than 50% of the voting base of coins. Rules for rewards and punishments need to be developed to encourage enough people to vote. If these incentives are designed correctly, the result provides the same level of securi- ty as Bitcoin (which is also vulnerable if a single miner requires more than 50% CPU mining), Ethereum (if it implements proof of participation), and so on.

The secure channel and delegated decentralized channel approaches are simple ways to load the protocol safely, which represent a compromise between complete decentralization and ease of use. Schelling points scheme is newer, but we believe that we will be able to make it reliable by developing right incentives. In any case, all of these implementations are valid alternatives for uploading CENTUS USD prices to the CENTUS protocol.

Currently, CENTUS loads real exchange rates into the blockchain using Coinbase, Kraken, and Binance exchanges. It will be possible to consider a decentralized scheme of Shelling points in the future, when expanding the network.

Increasing the supply works like it is described below.

The basic option of increasing supply is implemented through continuous sales of CENTUS and accrual of seigniorage to token owners 2 times a week on Tuesdays and Fridays. The interest rate is determined based on the results of voting of DBC owners.

Let us consider the option of increasing the supply via BILLEX.

First, the smart contract counts all outstanding BILLEX tokens and orders them by creation time, starting with the oldest ones. This ordered sequence of bonds is called the BILLEX Queue.

Then the smart contract counts all issued CENTUS tokens, creates N new CEN- TUS tokens and distributes them as follows:

- BILLEX owners are paid first in order of priority (FIFO-first in, first out). If there are unpaid BILLEX tokens, the smart contract starts converting BILLEX to CENTUS tokens, one to one, according to their place in the BILLEX Queue. For example, if we need to create 100 CENTUS, we convert the 100 oldest out- standing BILLEX into 100 new CENTUS tokens. The FIFO queue encourages people to buy BILLEX sooner rather than later, since BILLEX purchased earlier is paid out before BILLEX purchased later.

After paying off all BILLEX, the system starts distributing seigniorage again to all CENTUS owners automatically.- Seigniorage are accrued to DBC owners after BILLEX repayment and after distributing payments to all CENTUS owners. In this case, the system dis- tributes seigniorage (the remaining new coins) proportionally to the DBC owners. For example, if we need to create 1 million CENTUS and there are 0 issued (out- standing) BILLEX and 1 million DBC in circulation, then DBC owners will re- ceive between 10% and 50% of coins depending on CENTUS capitalization. The remaining coins are distributed among CENTUS owners.

To prevent situations in which new BILLEX at the end of the BILLEX Queue will not have value for speculators due to excessive queue length, we have provided a limit on the validity of the BILLEX. The more the BILLEX Queue grows, the longer it will take to pay for new BILLEX at the end of the queue. This leads to a lower price for the new BILLEX, as speculators begin to demand higher returns for the extra time and risk they take. But if the price of new BILLEX drops to zero, the system can no longer reduce the offer – zero price means that no one wants to ex- change their CENTUS tokens for BILLEX tokens. To prevent this from happening, we forcibly terminate all BILLEX that have been in the BILLEX queue for more than 1 year, even if they have not yet been redeemed. We chose the validity period of BILLEX 1 year after the simulation showed that this has led to the creation of a reliable system with high prices for BILLEX even in conditions of very large price fluctuations. However, we reserve the details for further discussion of expiration dates up to 5 years in individual cases.

The mechanism for increasing the supply will be easier to understand in the fol- lowing example:

Let us say there are 500 BILLEX bills in the BILLEX Queue, 200 of which were created more than 1 year ago.

Let us suggest the system needs to create 1000 new CENTUS coins.

The system removes the 200 oldest BILLEX from circulation, leaving 300 BILLEX in the queue. If the system needed to create less than 300 coins, it would only buy back the oldest BILLEX. However, the system must create 1000 coins, so it buys back all 300 BILLEX.

The system needs to create another 700 CENTUS coins. The system distributes these 700 coins evenly to existing owners of 1000 CENTUS and 1000 DBC. Each CENTUS and DBC gets 700/1000 = 0.7 / 2=3.5 coins. For example, if you have 100 CENTUS or 100 DBC, you will get 35 coins in the process of increasing the offer and then sell them for USD. (Subject to CENTUS capitalization at $10 mil- lion)

Supply reduction works as follows. To destroy CENTUS, we must have an effec- tive mechanism that will encourage CENTUS owners not to use their CENTUS in exchange for future payments. We do this by creating a smart contract for BILLEX tokens and then selling them to CENTUS owners. As discussed earlier, BILLEX tokens are sold at an open auction at prices usually less than 1 CENTUS. In return, they promise a future payment of one CENTUS during periods of in- creased supply if the old BILLEX is not in circulation, if the BILLEX has not ex- pired and the BILLEX has not been redeemed within 1 year.

First, we will discuss the open bidding system. To sell BILLEX, the smart contract launches a continuous auction where bidders specify the bid and number of new BILLEX tokens. In other words, auction participants indicate how much they want to pay for each BILLEX and how many BILLEX tokens they want to buy at that price. For example, you can specify that they would like to buy 100 BILLEX at 0.9 CENTUS for one BILLEX. When the system decides to reduce the coin sup- ply, it selects orders with the highest bids and converts the owners’ coins to BILLEX until enough CENTUS are destroyed. As an example:

Let us suggest the system wants to sell 100 BILLEX.

Let us assume that there are three purchase orders in the bid stack: one bid for 80 BILLEX at 0.8 CENTUS each, one bid for 80 BILLEX at 0.6 CENTUS each, and one bid for 80 BILLEX at 0.4 CENTUS each.

The system calculates the clearing (settlement) price, which is the single price at which all offered BILLEX would be purchased. In this case, the clearing price will be 0.6 CENTUS.

The system executes winning bids at the clearing price: the first user will receive 80 BILLEX in exchange for 80 * 0.6 = 48 CENTUS, and the second user will re- ceive 20 BILLEX in exchange for 20 * 0.6 = 12 CENTUS.

The protocol places an artificial cap on BILLEX token price to ensure that it will not sacrifice the future too much to enter into contracts to issue coins in the present. We currently set this level at 0.10 CENTUS per BILLEX. We modelled the prices of BILLEX to show that even with a very wide range of demand models for CENTUS, this level is almost never reached.

IMPORTANT: CENTUS issued on the Stellar blockchain are debited automati- cally from the addresses (accounts) of token holders using the Stellar Clawback function in case the rate deviates from the peg by more than 20%, followed by the accrual of BILLEX tokens in equal amounts.

Since the cost of producing paper money is low, the nominal value of a currency can be much higher than the cost of producing it. For example, it costs from 7 to 20 cents to print a US Federal reserve note depending on its face value. Conse- quently, the paper money printer makes a profit by creating more money. The value of money in comparison with its cost price is called seigniorage.

Seigniorage is the best tool for electronic money.

The largest number of seigniorages is associated with electronic money creation, since almost any amount of money can be created using electronics almost for free.

Similarly, CENTUS owners are entitled to receive an unconditional basic income from the seigniorage, which is a remuneration distributed among CENTUS own- ers.

We described earlier that the seigniorage is distributed twice a week – on Tuesdays and Fridays. The interest rate is determined by voting among participants – owners of CENTUS and DBC tokens.

According to the results of voting among participants on October 04, 2019, a deci- sion was made and recorded in the Telegram channel (https://t.me/coinger_im) to calculate votes based on two parameters:

- Medians of the seigniorage percent rates

- Majority of DBC votes

The values are calculated based on the average value of the two indicators.

At the same time, a mandatory condition for DBC token owners voting is the pres- ence of 100 DBC tokens or more on their wallet. This parameter can be changed up or down by DBC token owners’ decision.

More detailed calculation of the seigniorage percent rate Median value can be found in the description of the voting procedure: CENTUS Blog

As a result of monitoring the voting for the seigniorage rate among DBC owners held on 09.09.2019 and the analysis performed, it was decided to add the following to the current algorithm for calculating the seigniorage rate:

- Include the DBC asset ownership criterion in the calculation, considering 1 COIN = 1 VOTE. In other words, the more coins you have, the more weight your voice gains.

- After the votes are counted, award the BONUS in the minimum amount to those participants who vote only with one of the two voting assets. Subsequently, a transparent reward algorithm should be developed, possibly depending on the number of coins or based on a median prediction.

- Calculate the final seigniorage rate based on the rates that fall in the range be- tween the weighted 25th and 75th percentiles, based on the voting results.

- To reward people whose desired rates have fallen in the range from 25 to 75 per- centiles with a given amount of BONUS (perhaps the closer to the median, the higher the reward). The winners will receive an increased BONUS amount. This reward encourages people to vote and do it based on consensus.

- In order to prevent the undervaluation or overvaluation of economically justified seigniorage rates, people whose desired rates fall outside the 25 to 75 percentile range should not be rewarded with BONUS.

By weighing votes according to coin ownership, choosing an algorithm based on median calculation, and including a consensus-based reward mechanism, the scheme largely protects itself from unscrupulous participants, unless one of them owns more than 50% of the voting coin. This algorithm is excluded in the very principle of ownership of a DBC coin – no more than 30% for a single owner.

Implementation

The CENTUS monetary model is designed to support the CENTUS currency and provide confidence, especially when the currency market is still small. Its main functions include a reserve in USD stablecoins to maintain constant liquidity and reduce excessive volatility.

The CENTUS smart contract always offers to sell new CENTUS tokens or buy back and burn existing ones. This allows the market to determine the CENTUS supply while reducing volatility by limiting the price to within 0.01 USD peg.

Revenue from sale of CENTUS tokens is held in a reserve, the purpose of which is to ensure the value of CENTUS during the period when the currency acquires its independent trust. Funds in reserve is what allows the CENTUS smart contract to redeem CENTUS tokens when necessary. CENTUS reserves are stored only in USD stablecoins.

When more tokens are purchased from the CENTUS smart contract, the contract issues more coins; when tokens are sold back, they are redeemed from the reserve until the minimum level of 50% is reached, after which the BILLEX auction begins.

When the volume of CENTUS increases with the constant accrual of seigniorage, the total capitalization of CENTUS increases, although at the nominal price, the total value of tokens exceeds the CENTUS reserve. As a result, the CENTUS reserve does not contain the full market capitalization (cap) of CENTUS. In other words, the CENTUS reserve ratio is less than 100%.

The concept of a reserve ratio of less than 100% in the CENTUS context requires further clarification to avoid misunderstandings. For example, a reserve ratio of 95% does not mean that 95% of CENTUS issue revenue is deposited in the reserve, and the remaining 5% is withdrawn from the reserve for other use. Revenue is always fully deposited in the reserve; the decrease in the reserve ratio is due to the fact that the CENTUS contract awards seigniorage to token owners 2 times a week, increasing the supply of coins in the hands of owners. In other words, it is the CENTUS owners who benefit when our model reduces the reserve ratio – by increasing the number of their tokens.

Similarly, a 95% reserve ratio does not mean that the CENTUS contract will buy back only 95% of CENTUS tokens and become insolvent. Instead, the smart contract, when the reserve level reaches 50%, launches a discount auction of BILLEX and sells them to CENTUS owners in exchange for their tokens with a discount that is converted into profit when the bills are repaid later. Thus, the contract always has the ability to redeem any number of CENTUS tokens.

The CENTUS monetary model is primarily based on algorithms. All CENTUS project tokens are issued and circulated on the Stellar blockchain.

This transparently guarantees users that what they have been promised will actually be fulfilled. In the CENTUS model, our mechanism for providing liquidity, which allows participants to determine the CENTUS offer, is considered quite important, so it is implemented using the blockchain. We use a fully decentralized approach, so participants do not need to trust anyone to be sure that the code-based elements of our model are implemented exactly as described.

Not all components of the CENTUS model are based on computer code. Parts of CENTUS activities include interacting with the blockchain, such as managing reserves and awarding partner bonuses.

However, even when the implementation takes place outside of the blockchain, we strive to emulate the transparency of the blockchain as much as possible, informing CENTUS owners about such aspects.

In an ever-changing world, the CENTUS currency cannot rely on a static model. Code-based elements of our model may sometimes need to be modified. Other changes, such as working with new regulatory requirements, cannot be implement- ed through software algorithms. To keep up with the times successfully, the CEN- TUS currency must have a system for making decisions. It is also possible that we will use two blockchains, Stellar and Ethereum, in the work on smart contracts.

When the seigniorage is distributed among CENTUS owners, the number of tokens increases. As a result, the CENTUS reserve – the total net income from the sale of CENTUS tokens – contains less money than the market capitalization of CENTUS – the value of all CENTUS tokens in circulation.

The reserve ratio is defined as the percentage of the market value of CENTUS backed by CENTUS reserves. It reflects the level of market confidence in the CENTUS currency, regardless of the reserve.

For example, when people buy CENTUS knowing that the CENTUS reserve contains only 80% of the CENTUS market value, this is because they believe that CENTUS also has its own intrinsic value; otherwise, they sell CENTUS back to the CENTUS smart contract. Confidence in the independent value of CENTUS should be even higher if CENTUS are traded in the market when the reserve ratio is lower – say, 50%. In this case, the inherent value of CENTUS – its usefulness as a currency, its authority and recognition – is half its total value.

The reserve ratio also reflects the extent to which a CENTUS smart contract can affect the CENTUS price. When the reserve ratio is high, the CENTUS liquidity function has a great ability to mitigate price fluctuations. When the reserve ratio is lower, the CENTUS value is more determined and therefore depends on market confidence; the reserve plays a smaller role in stabilizing price movements.

The CENTUS reserve always remains solvent, even if the reserve ratio is less than 100%. When someone sells a CENTUS token back into a smart contract, the money that was put in reserve when the last token was issued goes to the seller.

The CENTUS monetary model is based on a variable reserve balance. It remains equal to 100% for the first 100 million tokens. At this stage, CENTUS is fully backed up. The CENTUS value is fixed and does not take into account changes in market confidence. Then, when more CENTUS are issued, the reserve ratio gradu- ally decreases, taking into account the increased confidence of the CENTUS market. The reserve ratio is slowly falling to a minimum of 10% when CENTUS market capitalization reaches US $ 1 billion.

Finally, after CENTUS capitalization reaches significant figures, it will no longer make sense to focus on the reserve in assessing the CENTUS value. The new stable system, which adjusts itself as necessary, will support the existence of CEN- TUS as an independent currency.

In this regard, our model simulates the evolution of other currencies: from fully backed by tangible assets (for example, the gold standard); to fractional reserves; based solely on the standard of its governing body.

The CENTUS reserve is stored only in USD stable coins, it shall not be invested anywhere, and serves only for the purchase of CENTUS via a smart contract or on the Stellar market (DEX). If the reserve account receives income from the demand/supply spread, this income used to support CENTUS shall be deposited in the CENTUS reserve.

Further development of CENTUS

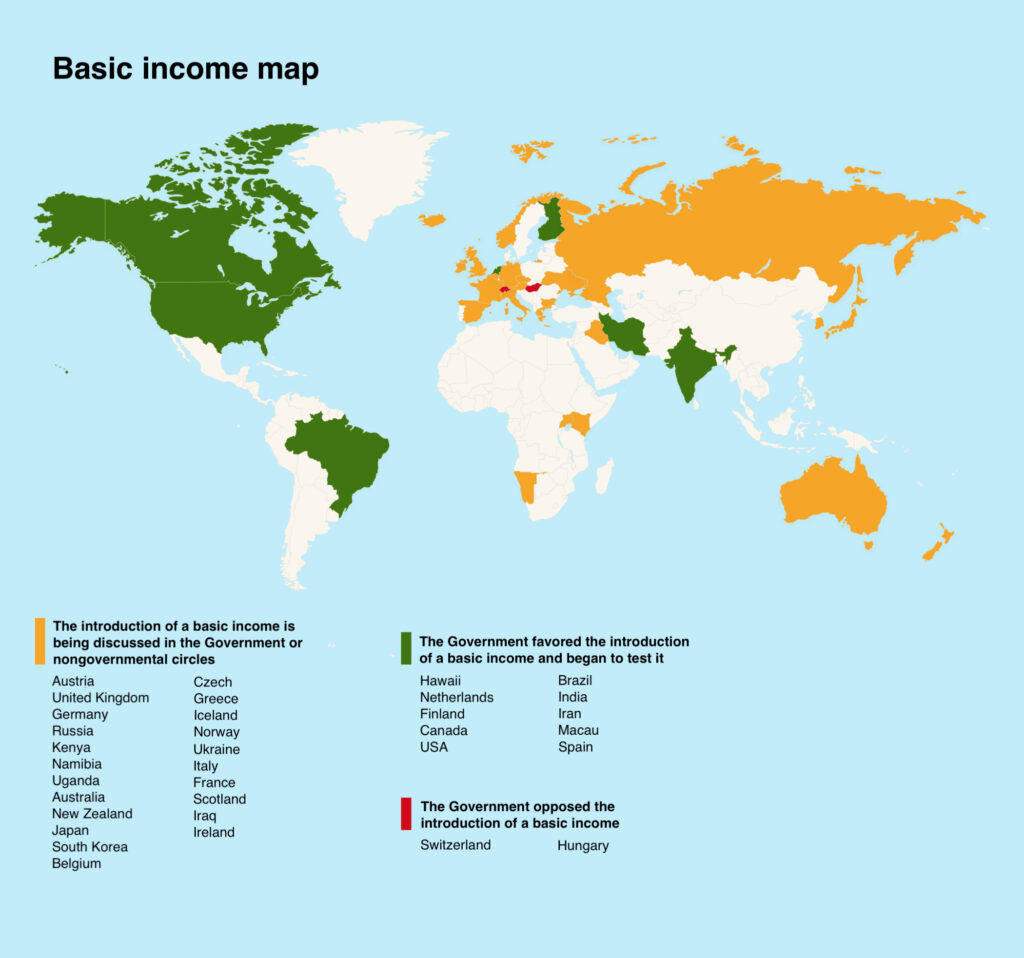

Universal basic income (UBI) is a state or other institutional material support for community members. Universal (guaranteed) income consists in the absence of additional (along with belonging to the society) requirements for receiving assistance. It is believed that such a support system can reduce financial anxiety and improve mental and physical health, increase motivation to work. Typical arguments against a decrease in the desire to work and a corresponding decrease in productivity.

This is a social concept that involves regular payments of a certain amount of money to each member of the community by the state or other institution (such institution is represented by CENTUS seigniorage network in this document).

Universal basic (unconditional) income is regular payments, which are sufficient to cover basic expenses: rent, food, and clothing. They are provided regularly, free of charge, without any counter obligations, and do not depend on age, marital status or income level.

Initially, this method of interaction between the state and the individual was considered from the point of view of eliminating excessive social inequality. This was a key goal. And as an economic background, they used such a concept as “social dividends”. It was introduced by Clifford Douglas, British major, who was convinced that every citizen is entitled to a part of the national wealth.

Everything looks quite logical: if you are a citizen of the country, then you also own part of the national wealth. It is like being a shareowner and receiving a part of the company’s profit in the form of dividends.

Attempts to introduce cyclical payments of UBI in different countries are accompanied by discussions and contradictions of opponents and supporters of this measure of socio-economic support of the population.

Taking into account different approaches, states are trying to replace social payments with monthly accruals of UBI, thereby giving to the society the right to dispose its income based on its needs. However, it was calculated that, if Switzerland had introduced such kind of social benefits, the expenditure for the introduction of this measure would have been about 200 billion dollars per year. Given the financial condition and small population of this country, this figure is significant even for them.

So far, the main sources for payments of universal income have been named as follows:

- Universal basic income should replace all existing social benefits.

- Higher taxes. This is nothing new, and now all social programs are implemented by the state at the expense of taxes. Nevertheless, at present, social benefits and taxes are not symmetrical, that is, taxes are paid by some people, and benefits are received by others. The progressive tax rate is designed to redistribute money from the richest to the poorest.

We can often hear reproaches such as why those who work should support those who do not work, or who, in the opinion of society, do not work enough. What can we reply? It is in the interests of society as a whole. At least, this is how economists and sociologists explain this fact.

In addition, the redistribution of funds between social strata by other means is becoming more difficult.- Another source of payment of universal basic income are funds saved on reducing the bureaucracy. After all, officials dealing with social payments will no longer be needed. Every citizen will simply receive the amount due to him or her on a monthly basis.

- One of the options for obtaining funds for the payment of universal basic income is seigniorage (income received from the issue of money and assigned by the issuer on the property rights).

A number of countries have successfully implemented UBI accrual policy.

Canada

One of the very first experiments on the payment of a universal basic income took place back in the 70s in the city of Dauphin (Canada). The project is called Mincome. According to the project, each resident of the city received monthly payments for 5 years. We must admit that this was one of the longest experiments organized at the state expense.

Evelyn Forget, an economist at the University of Manitoba, studied the results of this experiment. She noted in her report that the level of employment has not decreased at all. At the same time, the number of volunteers has increased, and the social activity of the population has increased.

The rate of hospitalization in the city decreased by 8.5%. During the experiment, a larger number of teenagers graduated from schools, rather than leaving school study unfinished.

Namibia

A coalition of organizations launched a pilot project in Ochivero village, Namibia, with a population of about 1,000 people. For a year, each resident of the village had received 100 Namibian dollars per month. As a result, men stopped illegal hunting, children were not starving, and many children improved their school performance. Employment increased by 11% as people opened pastry shops, hair-dressing salons and brick-making workshops. Additionally, crime rates dropped by 42%.

India

In 2011, the Association of women entrepreneurs, supported by UNICEF, conducted an experiment that lasted a year and a half. Each adult in 10 villages was paid 200 rupees and a child was paid 100 rupees monthly. Economic activity has increased, and food and school attendance have improved. The government of India took into account the results of the experiment, replacing 29 different social programs with direct payments to citizens.

In addition, this year, Arvind Subramanian, an economic adviser to the government of India, suggested that the introduction of unconditional income at the national level should be considered. In the annual report for the government, the estimated amount was also named – 7620 rupees or $113 per year. Even such a small amount, according to many, could significantly reduce the level of poverty in the country.

Germany

In 2014, the German entrepreneur Michael Bohmeyer started implementation of the pilot programme “Mein Grundeinkommen” (my basic income). Several dozen randomly selected people had been receiving 1,000 euros each month for a year.

All participants of the project note that their sleep has become much calmer. However, not much has changed in their lives in general as students continued to study, workers continued to work.

The author of the project noted that the idea of basic payments is based on four principles: it is universal, it solves individual problems, it does not depend on any conditions and creates a high minimum standard of living for citizens.

Many countries are in the middle of an “experiment” now. We will be able to evaluate the results only after some time. You can find few examples of these countries below.

Finland

The Finnish national insurance authority has proposed replacing social benefits with a fixed payment for all adult citizens of the country, regardless of income level. It is expected to set payments at 550 euros per month, and later raise to 800 euros.

Kenya

In October 2016, Givedirect, the New York based charity organization which fights poverty in East Africa, launched the largest project thus far for paying an universal basic income in Kenya. Residents of 40 villages will receive about $ 22.5 per month for 12 years. This is not just a charity event, but a scientific experiment aimed at collecting and analysing data on the effectiveness of universal basic income.

USA

Participants of the Economic Security Project, launched at the end of 2016, are researching the potential benefits of universal basic income in developed economies. The initiators of the project with a budget of 10 million dollars are more than 100 organizations and individuals, including Chris Hughes, Facebook cofounder, and Sam Altman, Y Combinator Foundation President.

Spain

As part of measures to mitigate the social and economic consequences of the coronavirus pandemic, the Spanish government is going to introduce a universal basic income in the near future. Nadia Calvino, Minister of Economic Affairs, announced this on April 5, 2020. The Spanish government wants to maintain a universal basic income even after the epidemic. The Minister of Economic Affairs expressed hope that the universal basic income will remain a “permanent structural tool”.

There are about 20 ongoing experiments in the world related to the payment of universal income. Scientists are trying to figure out whether we are motivated enough to continue working without starving.

Any member of the CENTUS seigniorage network, a coin owner, is entitled to receive basic income in the form of interest accrued on the amount of coins in his wallet. The basic income rate is determined by network participants – owners of DBC tokens intended for project management. This is done to prevent CENTUS coin owners from indefinitely inflating the interest paid, thus no excessive supply of coins is created on the market.

In the CENTUS seigniorage network, not only participants who bought coins can receive basic income. It is also possible for those members of the community who do not have the opportunity to purchase tokens to receive such income. To do this, participants can promote the project at a certain stage by earning and accumulating special bonuses, which they can convert to CENTUS and receive basic income. Of course, they can sell these coins at any convenient moment.

In the future, as the project develops and the capitalization of CENTUS increases, in addition to interest charges, it is planned to add a payment of a minimum fixed amount in absolute terms, for example, from $50-100 to several hundred US dollars, to each CENTUS participant.

At the initial stage, we reserve the right to use any combination of seigniorage (basic income) payments, including dividing accruals depending on how CENTUS was received: for example, those who purchased tokens at their own expense can count on the maximum payout, while those who received them through bonus and other exchanges, as well as various incentive programs can receive accruals par- tially.

People living in developed countries take for granted the availability of a stable currency. If you are in the US with unlimited access to dollars or in the EU with access to euros, you may wonder why the world needs a digital currency with a stable price. However, in countries with weak financial institutions and unstable currencies, high rates of inflation and currency devaluation are common. We expect CENTUS with its stable price and integral seigniorage to be in high demand in these markets.

At the time of publication in the second quarter of 2020, annual inflation in Egypt was 6.8%, in Argentina – 50.3%, and in Nigeria – 12.2%. These are only those countries whose governments are relatively more stable. Let us look at Venezuela, which currently has an annual inflation rate of 9586%. What would you do if your savings were disappearing at a rate of 9586% a year? Faced with a rapidly depreciating local currency, people are looking for other ways to survive, often leaning towards the dollar. This effect is known as dollarization.

It usually takes three forms:

- First, the population may prefer to use the dollar instead of the local currency without any coordination from the local government. The US dollar is used as a de facto currency in a number of countries in Central Asia and Sub-Saharan Africa, and its adoption rate can be extremely high, despite the lack of official coordination. For example, for 2 years from 2006 to 2008, dollarization in the Seychelles jumped from 20% to 60%.

- Secondly, citizens of a country can demand the dollar, despite state capital controls that prevent the movement of the dollar across its borders. It is no secret that there was a black dollar market in Argentina, known as dollar blue, during the period of capital control from 2011 to 2015. Over those years, between $ 10 and $ 40 million per day changed hands at rates that were 25-30% higher than the official rate. These bets were even published daily in national newspapers, despite being officially illegal.

- Third, currency devaluation can become so severe that governments can officially switch to US dollars, as happened in Zimbabwe in 2009. Today the entire country requires regular deliveries of physical paper dollars and coins.

The prospects are obvious. Regardless of whether dollarization is officially approved, citizens, banks, and governments incur significant costs when importing physical US dollars. CENTUS, which allows millions of dollars to be transported by making the phone call and generates regular income, seems to be a significantly better alternative to paper dollars in all dollarization scenarios.

In conclusion: existing digital currencies have found an appeal in some countries with hyperinflation, for example, the use of bitcoins in Venezuela is growing as the country has faced a currency crisis. However, Bitcoin can never truly free people from their unstable local currency due to the lack of quote stability. For example, if bitcoin goes through a devaluation cycle, users do not see the difference between devaluing bitcoin and devaluing the local currency. Even if bitcoin only crashes once, people will want to switch to an alternative that is stable in price – if such option exists. Thus, the CENTUS seigniorage stablecent, which allows you to receive regular income, will be an excellent solution for developing countries experiencing rapid currency devaluation.

Today, many participants of the crypto market traders convert their cryptocurrency into stable coins pegged to the US dollar when there is turbulence in the cryptocurrency markets. To meet this need, a centralized solution, known as USD Tether, has been generated, but for reasons to be discussed later, a centralized solution such as Tether is unlikely to work in the long term, and as a result, Tether has faced significant negative sentiment. In addition, when the market falls and the trader keeps their assets in a regular stable coin, such as USD Tether, he does not get any profit, unlike CENTUS, which also has a stable price and at the same time brings income (seigniorage) to its owner.

A seigniorage digital currency with a stable price can meet the needs of digital traders. Therefore, cryptocurrency traders can naturally be enthusiastic about the new protocols, and here we expect initial demand for CENTUS Stable Cent.

CENTUS combines a digital currency that brings its owner a profit in the form of a seigniorage at the growth stage, and a stable coin pegged to the US dollar.

Due to instability, today’s cryptocurrencies are not suitable for even the most basic financial contracts that our economy relies on. Can you imagine a job for which you get one bitcoin per month, but you pay all your monthly bills in US dollars – what will happen to you and your family if the price of BTC falls? How about buying a home with a 30-year mortgage denominated in bitcoin, in a world where you probably still get paid in dollars? It is impossible to predict the development of events in such cases, because the credit and debt markets, and in fact the markets for any financial contract over time depend on price stability.

When entering a mortgage agreement, the greatest risk that you take as a lender is the risk of default. However, if this mortgage was denominated in an unstable asset such as Bitcoin, you are also exposed to a very high price risk. For example, the cost of a 30-year bitcoin-denominated mortgage may suddenly be very low if the price of Bitcoin falls by 90% on any given day over the next 30 years. To make deals, you must be prepared to either speculate on the price of Bitcoin for each loan you provide or find a specialist who will do this. In any case, the borrower will have to pay for your willingness to hedge price risks. This adds aspects, which are difficult to negotiate, to the simplest financial contracts.

A number of visionaries in the blockchain industry believe that we will soon see an ecosystem of “blockchain applications” that implement existing services with decentralized tools. For example, one day we may see “Uber blockchain” or “Airbnb blockchain”, each using its own tokens. In fact, this is already happening with Filecoin, a service for decentralized file storage on the Internet.

Of course, if each blockchain application will create its own token, then there must be a conversion system between “a universal token that during its holding brings a constant income and has 100% liquidity” and the tokens of any of these applications. We assume that each person will become a owner of a universal token and will pay with it when using any blockchain application. Then, after payment, the universal token will be immediately converted into an app token at the market rate. This will be similar to your bank account in US dollars and using your debit card in another country, such as Spain, in which case your bank converts your US dollars to euros at the market rate every time you make a purchase, without having to think about it. At the same time, you also get a regular basic in- come in the form of a seigniorage for tokens.

If there were this ecosystem of blockchain applications that would require the use of a universal token, it would be very strange if this universal token were not stable in price with the condition of regularly received income. In other words, if you believe in the future of blockchain applications, you not only have to believe that a stable price coin will be required for exchange, but also hope that a stable price coin will be successful.

Annex

White Paper – documentation that describes the project, new process, or algorithm in detail. It is part of the company’s content strategy. Its purpose is to provide useful information about solving a particular problem.

Token, digital token – a term used in the cryptocurrency environment to refer to an intangible asset, a tool that gives access to certain services, or an internal currency.

Cryptocurrency – a type of digital currency, creation and control of which are based on cryptographic methods. As a rule, the record system of cryptocurrencies is decentralized. The functioning of these systems is based on blockchain technology. Transaction information is usually not encrypted and is available to public. Cryptographic elements are used to ensure that the transaction block chain database is unchanged (digital signature based on a public key system, sequential hashing).

Blockchain – a continuous sequential chain of blocks (a connected list) built according to certain rules that contain information (about transactions, agreements, and contracts). Copies of block chains are stored and processed independently on many different computers. Most often, the blockchain contains information about transactions in various cryptocurrencies, but blocks can also contain other information.

Decentralization – the process of distributing functions across the entire system without a single centre. A decentralized network (Peer-to-peer network) is a computer network based on the equality of participants. Often there are no dedicated servers in such a network, and each node (peer) is a client and in the same time function as a server. This organization allows you to maintain network performance with any number and any combination of available nodes.

Smart contract – program code that describes a set of conditions that cause certain events in computing systems to occur. It is designed for technical implementation of conclusion and maintenance of commercial contracts in the blockchain technology.

Stellar – an open source network for currencies and payments. The software operates in a decentralized open network and processes millions of transactions daily. Stellar relies on the blockchain for network synchronization.

Stellar address – a unique set of characters for sending / receiving cryptocurrency. Addresses are not repeated in the network. The address also acts as a public key that is used to sign blocks.

Fiat money – ordinary money, the nominal value of which is set and guaranteed by the state (dollars, euros, rubles).

The purpose of this White Paper is to provide information about the CENTUS project to potential buyers of CENTUS stable cent, DBC token, BILLEX token on the basis of which it will be possible to make a purchase decision. The information provided in this document is not exhaustive and does not imply any contractual obligations and can only be considered as marketing information about the project. The project information in this document is subject to change, update without prior notice and cannot be considered as a form of obligations of CENTUS, as well as related legal entities that support the project. CENTUS reserves the right to change the text of this document without any prior notice and at any convenient time.

Nothing in this document can be interpreted as an investment offer of any kind. This offer is not an offer to sell or buy securities in any jurisdiction. This document does not offer to purchase tokens to individuals and companies that do not have sufficient legal capacity to participate in a monetary exchange.

If you are not sure that you are eligible to participate in the CENTUS project, you should contact a professional legal, financial, tax or other consultant. Participation in the CENTUS project is voluntary.

What did inspire us to create CENTUS Stable Cent?

Basis is a project that also introduced the idea of increasing and reducing the supply of coins to maintain the rate peg. Basis was launched in 2017 and closed at the end of 2018, with $ 133 million in funds raised, an impressive list of advisors and a powerful team. The reason was that under US law, their tokens were considered securities and were subject to restrictions for securities.

We like lots of things about the Basis project, and this document relies heavily on their White Paper. We decided to take the best out of it but improved the scheme by adding a seigniorage payment to all CENTUS token owners, as well as a partial reserve to the smart contract, which acts as a market maker for participants, selling and buying CENTUS by using reserves.

We took into account the legal problems of Basis and offered BILLEX bills of exchange instead of bonds, which the participants themselves create through a smart contract in exchange for CENTUS. In this case, the legislative problem is completely solved, because any individual or legal entity can issue bills without the need to have a license, since the issue of bills is regulated by the Law of Great Britain on Bills (1882), which clearly specifies the procedure for their issue and circulation. CENTUS Protocol only offers participants a convenient platform for issuing BILLEX discount bills of exchange under their CENTUS. In addition, the CENTUS system with its partial reservation will allow increasing the supply without a mandatory 100% security, which will allow more flexibility in the policy of increasing the supply, especially at the first stages of development.

Imagine a world in which Bitcoin begins to compete with US dollars for the use of transactions. You are paid in bitcoins, but you pay for rent in dollars, or perhaps vice versa. This just does not make sense, given the inherent volatility of Bitcoin.

This article has presented CENTUS — a reliable, decentralized implementation of digital currency with a stable price and regular seigniorage for coin owners. We believe that if we can just make sure that the purchasing power of the currency does not change, people will give up the idea that it is not worth having a lot of digital currencies, and come to the understanding that storing their savings or incomes in CENTUS Stable Cent is reliable and profitable. We believe that this feature will help our tokens pass the acceptance cycle and help them move to the main exchange environment – a result that no other digital currencies has yet managed to achieve.

If you have any thoughts or would like to participate in the project, feel free to write to the authors listed on the title page. For the most up-to-date version of this document, visit the website http://www.centus.one